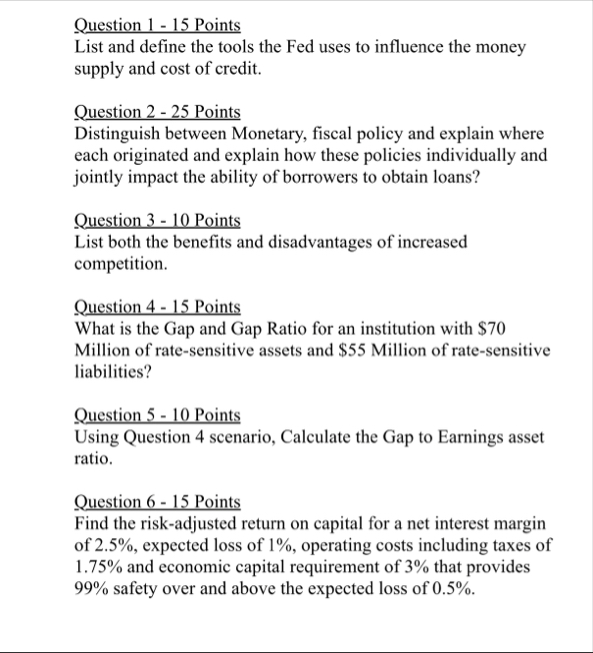

Question: Question 1 - 1 5 Points List and define the tools the Fed uses to influence the money supply and cost of credit. Question 2

Question Points

List and define the tools the Fed uses to influence the money supply and cost of credit.

Question Points

Distinguish between Monetary, fiscal policy and explain where each originated and explain how these policies individually and jointly impact the ability of borrowers to obtain loans?

Question Points

List both the benefits and disadvantages of increased competition.

Question Points

What is the Gap and Gap Ratio for an institution with $ Million of ratesensitive assets and $ Million of ratesensitive liabilities?

Question Points

Using Question scenario, Calculate the Gap to Earnings asset ratio.

Question Points

Find the riskadjusted return on capital for a net interest margin of expected loss of operating costs including taxes of and economic capital requirement of that provides safety over and above the expected loss of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock