Question: Question 1 1 5 pts Consider a long - term project undertaken by a U . S . - based multinational corporation ( MNC )

Question

pts

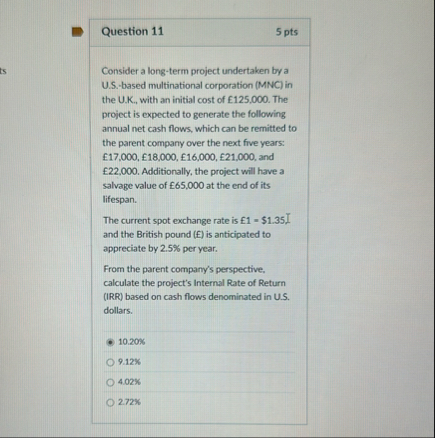

Consider a longterm project undertaken by a USbased multinational corporation MNC in the UK with an initial cost of The project is expected to generate the following annual net cash flows, which can be remitted to the parent company over the next five years: and Additionally, the project will have a salvage value of at the end of its lifespan.

The current spot exchange rate is $I and the British pound is anticipated to appreciate by per year.

From the parent company's perspective. calculate the project's Internal Rate of Return IRR based on cash flows denominated in US dollars.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock