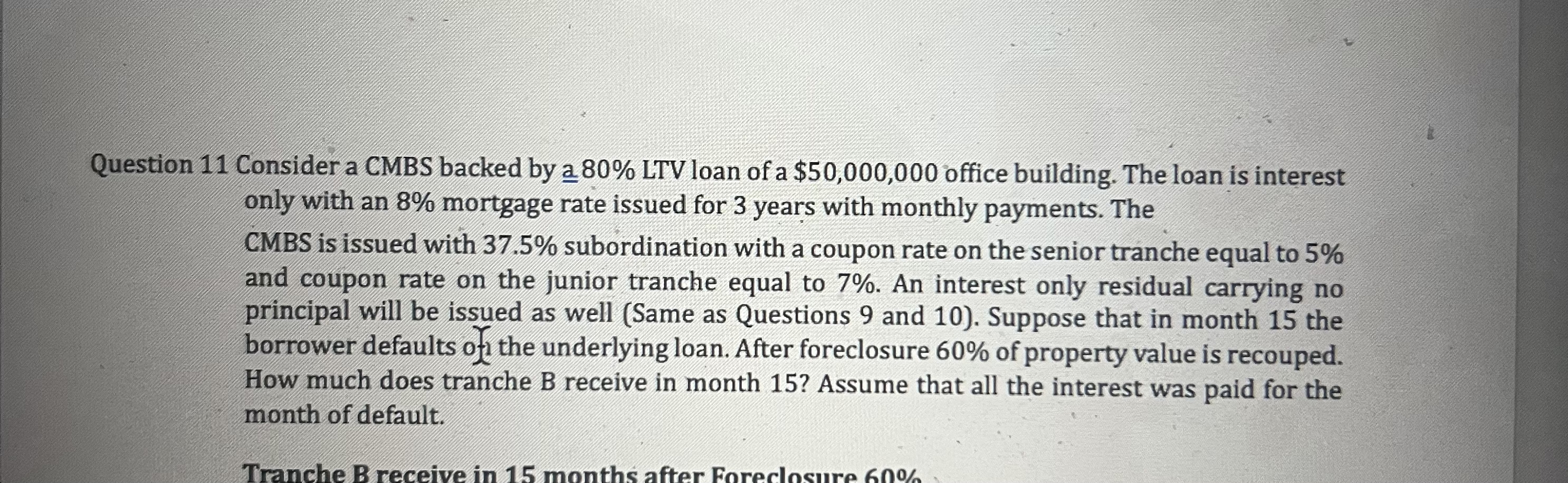

Question: Question 1 1 Consider a CMBS backed by a 8 0 % LTV loan of a $ 5 0 , 0 0 0 , 0

Question Consider a CMBS backed by a LTV loan of a $ office building. The loan is interest only with an mortgage rate issued for years with monthly payments. The CMBS is issued with subordination with a coupon rate on the senior tranche equal to and coupon rate on the junior tranche equal to An interest only residual carrying no principal will be issued as well Same as Questions and Suppose that in month the borrower defaults of the underlying loan. After foreclosure of property value is recouped. How much does tranche B receive in month Assume that all the interest was paid for the month of default.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock