Question: QUESTION 1 1 . Exercise - Governmental Accounting Part I: General Fund Journal Entries City of Good Citizen has the following transactions during fiscal year

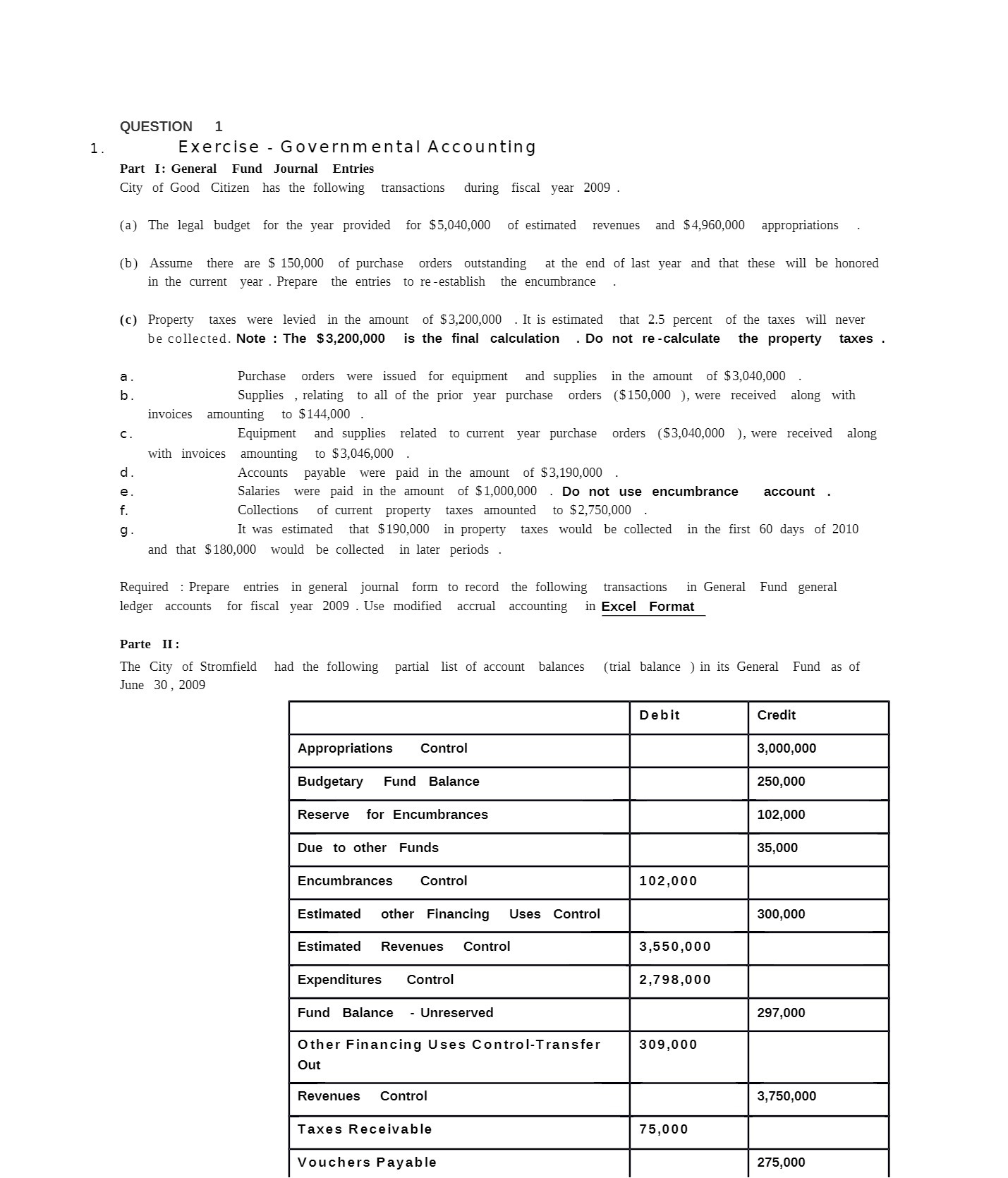

QUESTION 1 1 . Exercise - Governmental Accounting Part I: General Fund Journal Entries City of Good Citizen has the following transactions during fiscal year 2009 (a) The legal budget for the year provided for $5,040,000 of estimated revenues and $4,960,000 appropriations (b) Assume there are $ 150,000 of purchase orders outstanding at the end of last year and that these will be honored in the current year . Prepare the entries to re-establish the encumbrance (c) Property taxes were levied in the amount of $3,200,000 . It is estimated that 2.5 percent of the taxes will never be collected. Note : The $3,200,000 is the final calculation . Do not re-calculate the property taxes a Purchase orders were issued for equipment and supplies in the amount of $3,040,000 Supplies , relating to all of the prior year purchase orders ($150,000 ), were received along with invoices amounting to $144,000 . C Equipment and supplies related to current year purchase orders ($3,040,000 ), were received along with invoices amounting to $3,046,000 . d Accounts payable were paid in the amount of $3,190,000 Salaries were paid in the amount of $1,000,000 . Do not use encumbrance account Collections of current property taxes amounted to $2,750,000 It was estimated that $190,000 in property taxes would be collected in the first 60 days of 2010 and that $180,000 would be collected in later periods Required : Prepare entries in general journal form to record the following transactions in General Fund general ledger accounts for fiscal year 2009 . Use modified accrual accounting in Excel Format Parte II : The City of Stromfield had the following partial list of account balances (trial balance ) in its General Fund as of June 30, 2009 Debit Credit Appropriations Control 3,000,000 Budgetary Fund Balance 250,000 Reserve for Encumbrances 102,000 Due to other Funds 35,000 Encumbrances Control 102,000 Estimated other Financing Uses Control 300,000 Estimated Revenues Control 3,550,000 Expenditures Control 2,798,000 Fund Balance - Unreserved 297,000 Other Financing Uses Control-Transfer 309,000 Out Revenues Control 3,750,000 Taxes Receivable 75,000 Payable 275,000