Question: Question 1 (1 point) A widow with a dependent child uses the married filing jointly filing status for the two years immediately after the year

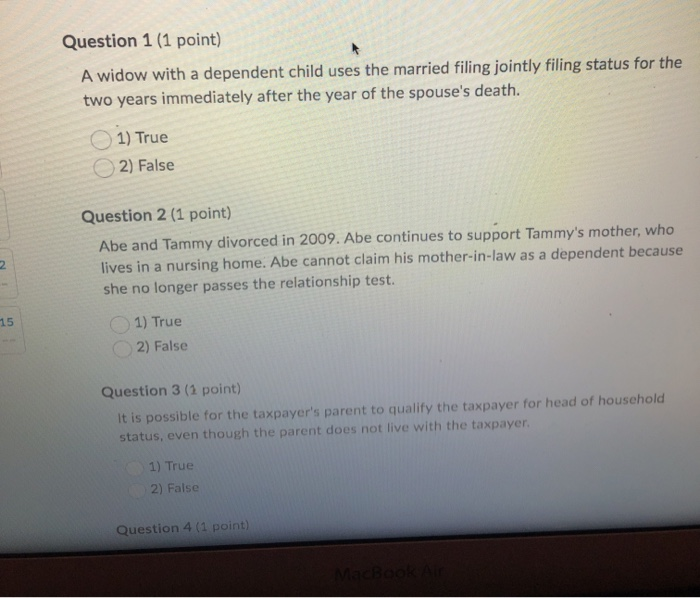

Question 1 (1 point) A widow with a dependent child uses the married filing jointly filing status for the two years immediately after the year of the spouse's death. 1) True 2) False Question 2 (1 point) Abe and Tammy divorced in 2009. Abe continues to support Tammy's mother, who lives in a nursing home. Abe cannot claim his mother-in-law as a dependent because she no longer passes the relationship test. ( 1) True 2) False Question 3 (2 point) It is possible for the taxpayer's parent to qualify the taxpayer for head of household status, even though the parent does not live with the taxpayer 1) True 2) False Question 4 (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts