Question: Question 1 (1 point) According to the Rational Expectations Hypothesis: Given two securities of different risk, a rational investor will always choose the one with

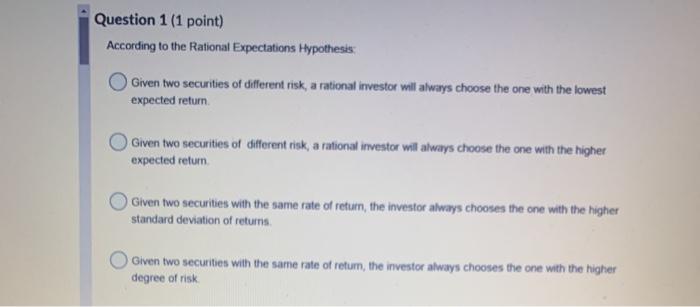

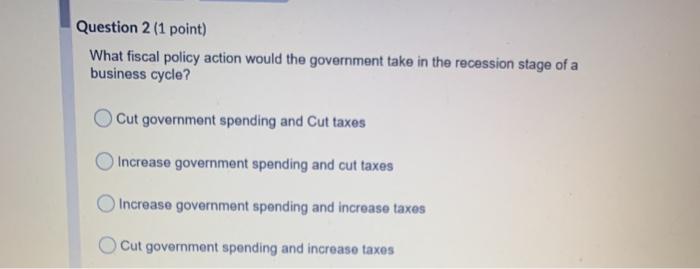

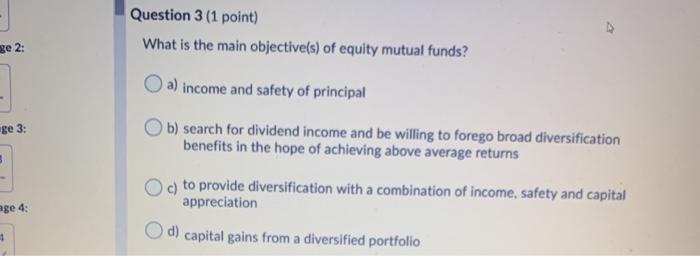

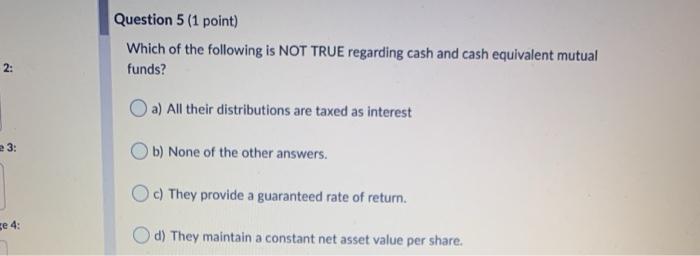

Question 1 (1 point) According to the Rational Expectations Hypothesis: Given two securities of different risk, a rational investor will always choose the one with the lowest expected return Given two securities of different risk, a rational investor will always choose the one with the higher expected return Given two securities with the same rate of return, the investor always chooses the one with the higher standard deviation of returns. Given two securities with the same rate of retum, the investor always chooses the one with the higher degree of risk Question 2 (1 point) What fiscal policy action would the government take in the recession stage of a business cycle? Cut government spending and Cut taxes Increase government spending and cut taxes Increase government spending and increase taxes Cut government spending and increase taxes Question 3 (1 point) What is the main objective(s) of equity mutual funds? se 2: ge 3: a) income and safety of principal b) search for dividend income and be willing to forego broad diversification benefits in the hope of achieving above average returns c) to provide diversification with a combination of income, safety and capital appreciation O d) capital gains from a diversified portfolio age 4: Question 5 (1 point) Which of the following is NOT TRUE regarding cash and cash equivalent mutual funds? 2: a) All their distributions are taxed as interest 3: b) None of the other answers. c) They provide a guaranteed rate of return. se 4: d) They maintain a constant net asset value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts