Question: Question 1 (1 point) Cay Paints Co. is considering a 2-year project with an initial purchase of $200,000 in net fixed assets. The project will

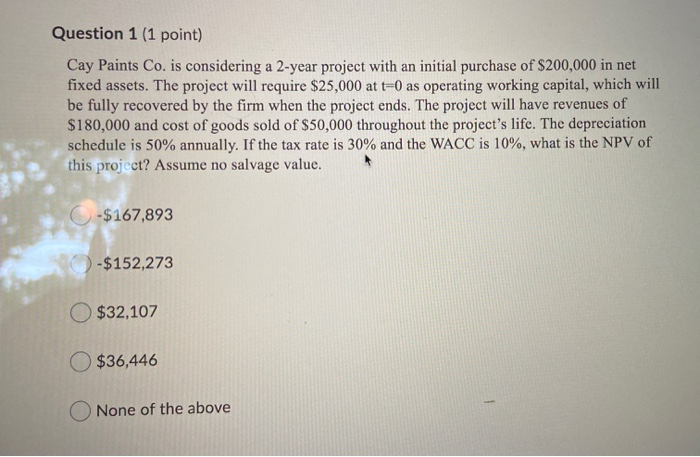

Question 1 (1 point) Cay Paints Co. is considering a 2-year project with an initial purchase of $200,000 in net fixed assets. The project will require $25,000 at t=0 as operating working capital, which will be fully recovered by the firm when the project ends. The project will have revenues of $180,000 and cost of goods sold of $50,000 throughout the project's life. The depreciation schedule is 50% annually. If the tax rate is 30% and the WACC is 10%, what is the NPV of this project? Assume no salvage value. -$167,893 ) -$152,273 $32,107 $36,446 O None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock