Question: Question 1 (1 point) Company ABC has a return on equity (ROE) that is equal to the required rate of return (given by the CAPM).

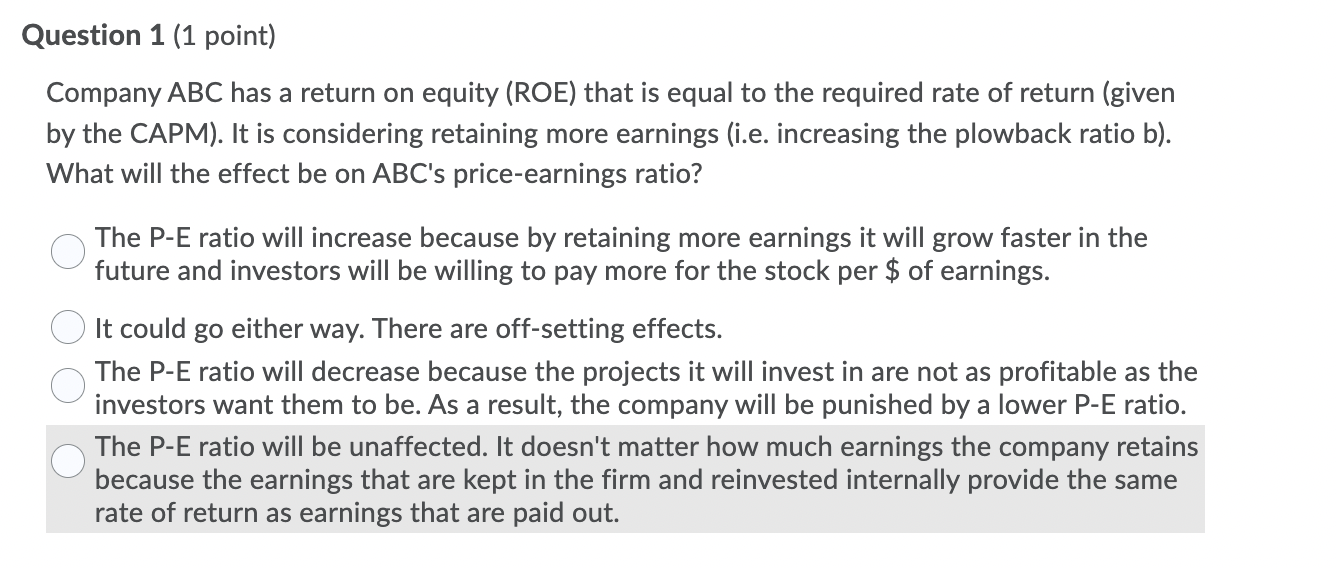

Question 1 (1 point) Company ABC has a return on equity (ROE) that is equal to the required rate of return (given by the CAPM). It is considering retaining more earnings (i.e. increasing the plowback ratio b). What will the effect be on ABC's price-earnings ratio? The P-E ratio will increase because by retaining more earnings it will grow faster in the future and investors will be willing to pay more for the stock per $ of earnings. It could go either way. There are off-setting effects. The P-E ratio will decrease because the projects it will invest in are not as profitable as the investors want them to be. As a result, the company will be punished by a lower P-E ratio. The P-E ratio will be unaffected. It doesn't matter how much earnings the company retains because the earnings that are kept in the firm and reinvested internally provide the same rate of return as earnings that are paid out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts