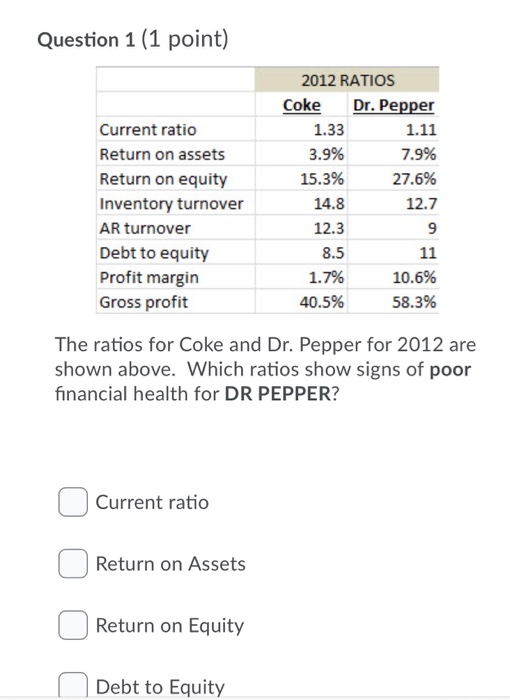

Question: Question 1 (1 point) Current ratio Return on assets Return on equity Inventory turnover AR turnover Debt to equity Profit margin Gross profit 2012 RATIOS

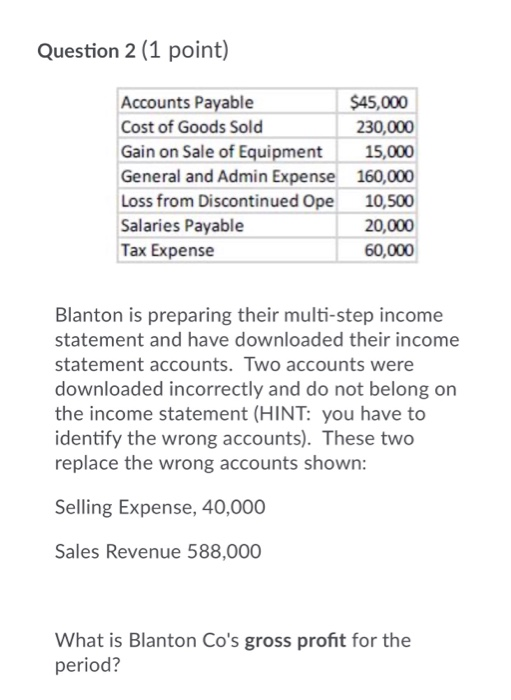

Question 1 (1 point) Current ratio Return on assets Return on equity Inventory turnover AR turnover Debt to equity Profit margin Gross profit 2012 RATIOS Coke Dr. Pepper 1.33 1.11 3.9% 7.9% 15.3% 27.6% 14.8 12.7 12.3 9 8.5 11 1.7% 10.6% 40.5% 58.3% The ratios for Coke and Dr. Pepper for 2012 are shown above. Which ratios show signs of poor financial health for DR PEPPER? Current ratio Return on Assets Return on Equity Debt to Equity Question 2 (1 point) Accounts Payable $45,000 Cost of Goods Sold 230,000 Gain on Sale of Equipment 15,000 General and Admin Expense 160,000 Loss from Discontinued Ope 10,500 Salaries Payable 20,000 Tax Expense 60,000 Blanton is preparing their multi-step income statement and have downloaded their income statement accounts. Two accounts were downloaded incorrectly and do not belong on the income statement (HINT: you have to identify the wrong accounts). These two replace the wrong accounts shown: Selling Expense, 40,000 Sales Revenue 588,000 What is Blanton Co's gross profit for the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts