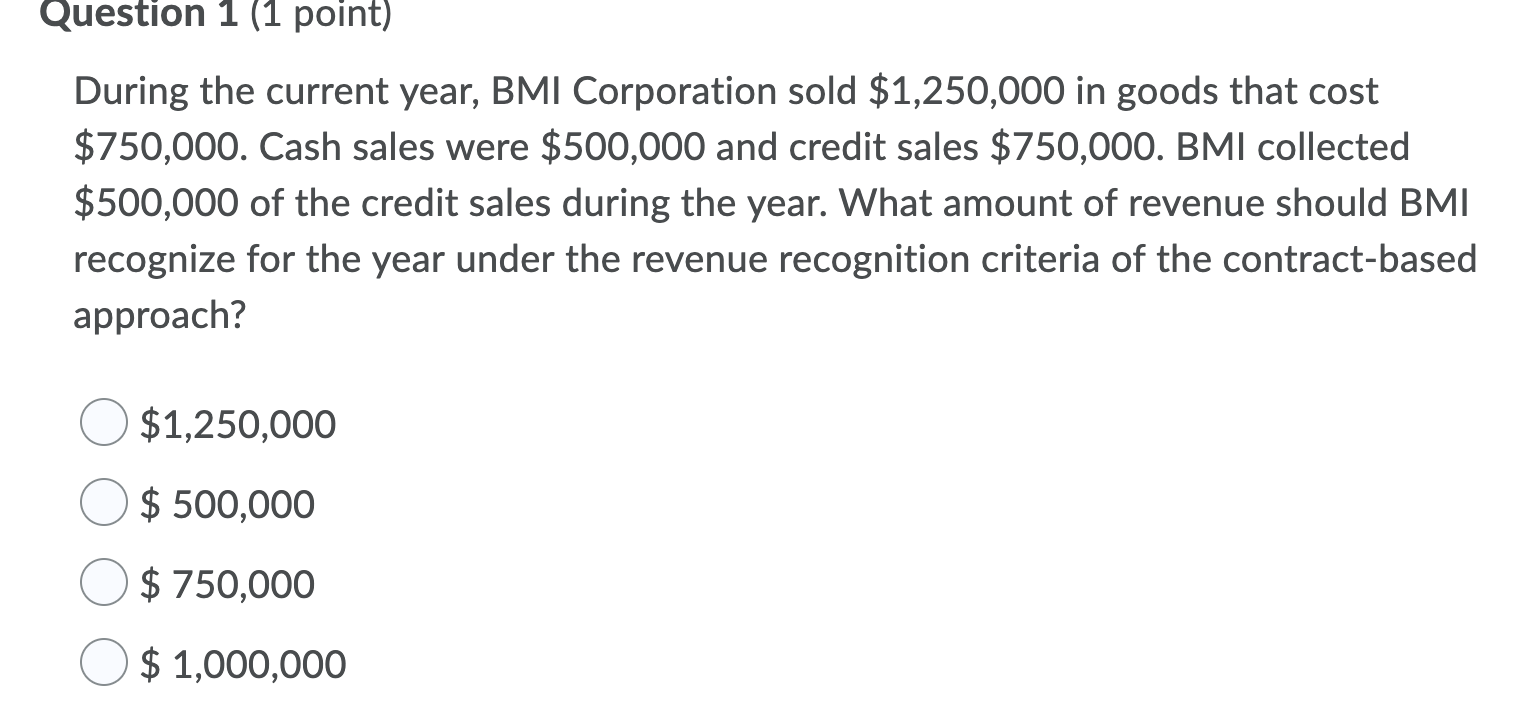

Question: Question 1 (1 point) During the current year, BMI Corporation sold $1,250,000 in goods that cost $750,000. Cash sales were $500,000 and credit sales $750,000.

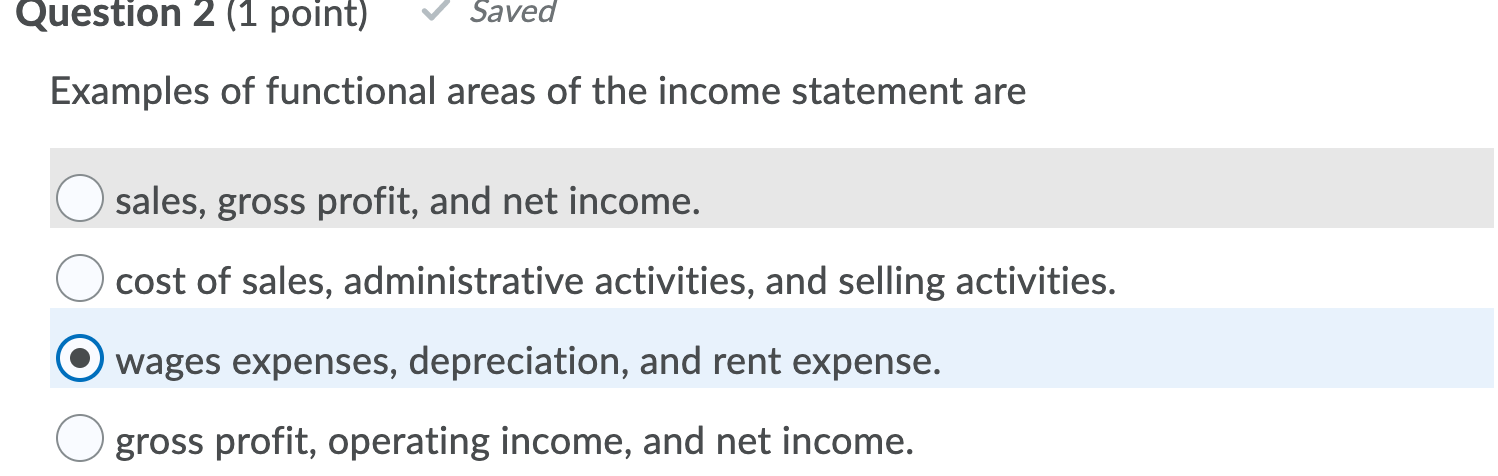

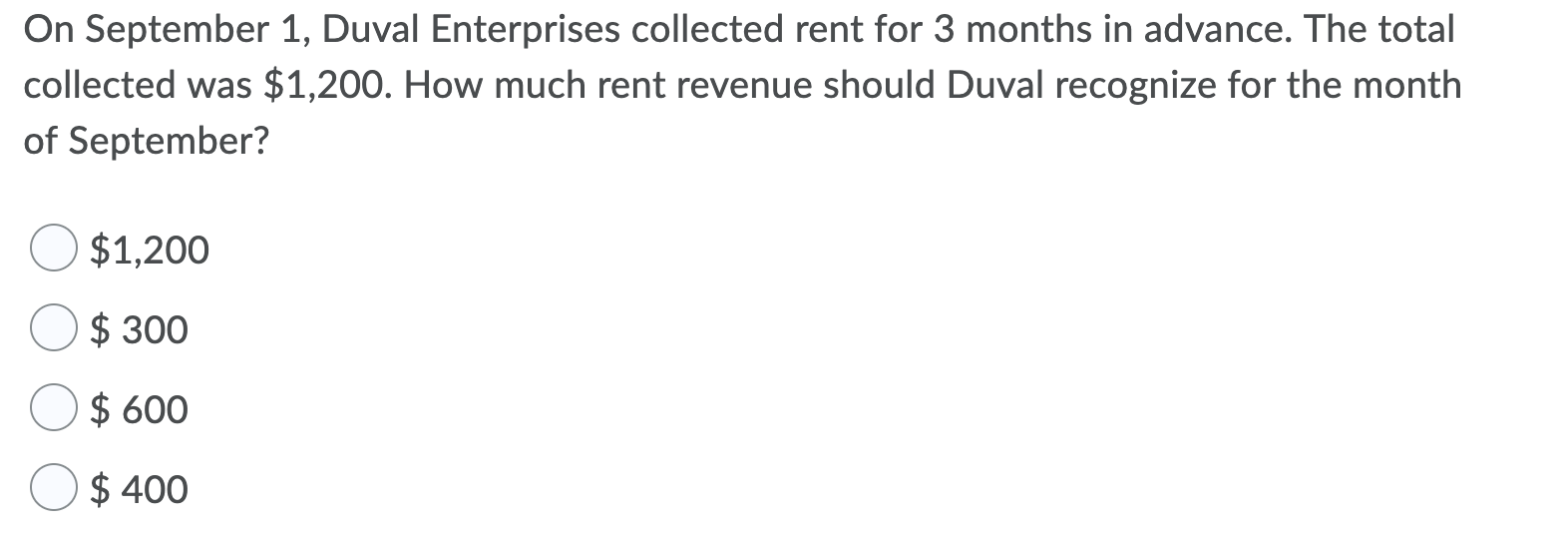

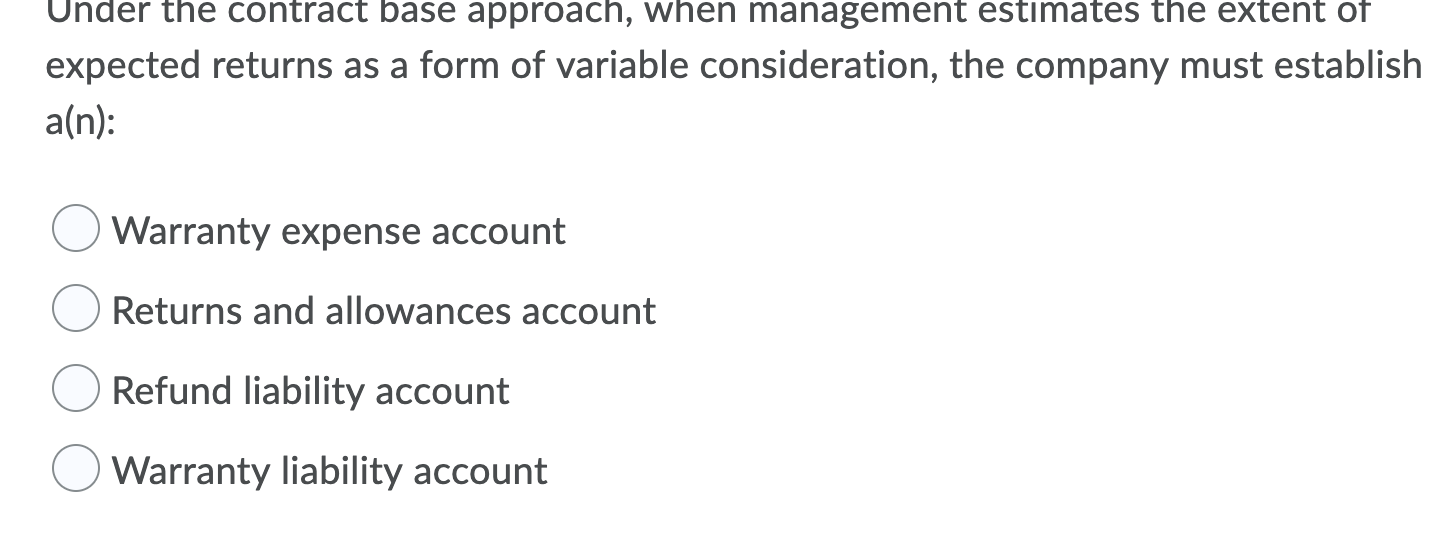

Question 1 (1 point) During the current year, BMI Corporation sold $1,250,000 in goods that cost $750,000. Cash sales were $500,000 and credit sales $750,000. BMI collected $500,000 of the credit sales during the year. What amount of revenue should BMI recognize for the year under the revenue recognition criteria of the contract-based approach? $1,250,000 $ 500.000 $ 750,000 $ 1,000,000 Question 2 (1 point) Saved Examples of functional areas of the income statement are sales, gross profit, and net income. cost of sales, administrative activities, and selling activities. wages expenses, depreciation, and rent expense. gross profit, operating income, and net income. On September 1, Duval Enterprises collected rent for 3 months in advance. The total collected was $1,200. How much rent revenue should Duval recognize for the month of September? $1,200 $ 300 $ 600 $ 400 Under the contract base approach, when management estimates the extent of expected returns as a form of variable consideration, the company must establish a(n): Warranty expense account Returns and allowances account Refund liability account Warranty liability account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts