Question: Question 1 (1 point) Jane is offered a pension plan through her employer. The plan agrees that if she will deposit 6% of her salary

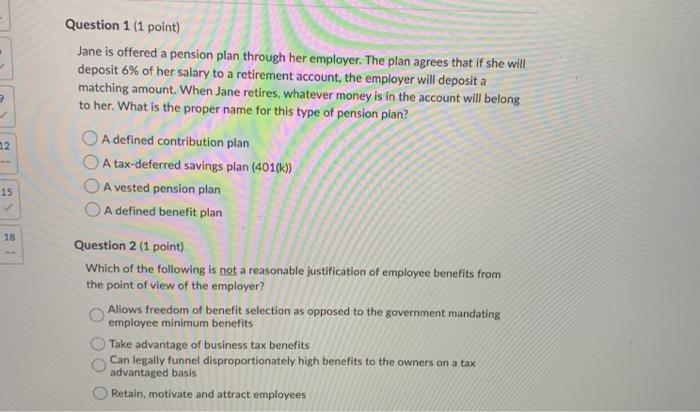

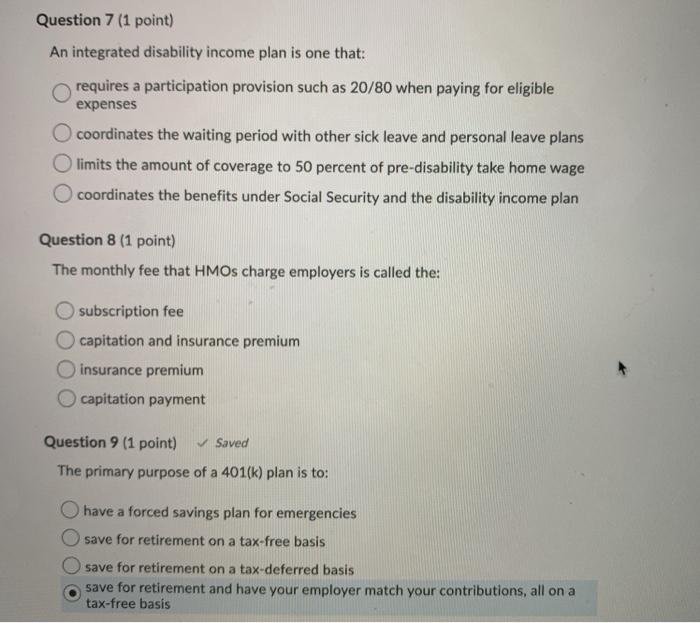

Question 1 (1 point) Jane is offered a pension plan through her employer. The plan agrees that if she will deposit 6% of her salary to a retirement account, the employer will deposit a matching amount. When Jane retires, whatever money is in the account will belong to her. What is the proper name for this type of pension plan? A defined contribution plan A tax-deferred savings plan (401(k)) A vested pension plan A defined benefit plan 12 15 18 Question 2 (1 point) Which of the following is not a reasonable justification of employee benefits from the point of view of the employer? Allows freedom of benefit selection as opposed to the government mandating employee minimum benefits Take advantage of business tax benefits Can legally funnel disproportionately high benefits to the owners on a tax advantaged basis Retain, motivate and attract employees Question 7 (1 point) An integrated disability income plan is one that: O requires a participation provision such as 20/80 when paying for eligible expenses O coordinates the waiting period with other sick leave and personal leave plans limits the amount of coverage to 50 percent of pre-disability take home wage O coordinates the benefits under Social Security and the disability income plan Question 8 (1 point) The monthly fee that HMOs charge employers is called the: subscription fee capitation and insurance premium insurance premium capitation payment Question 9 (1 point) Saved The primary purpose of a 401(k) plan is to: have a forced savings plan for emergencies save for retirement on a tax-free basis save for retirement on a tax-deferred basis save for retirement and have your employer match your contributions, all on a tax-free basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts