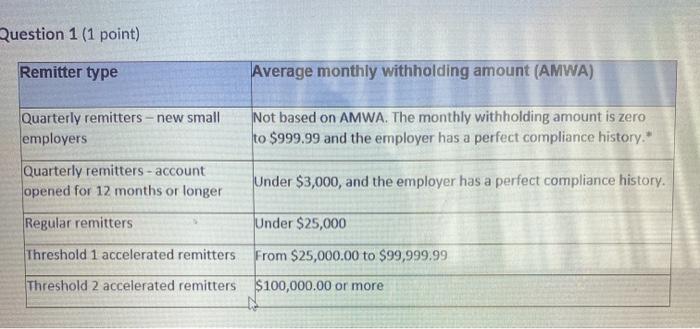

Question: Question 1 (1 point) Remitter type Average monthly withholding amount (AMWA) Quarterly remitters - new small employers Not based on AMWA. The monthly withholding amount

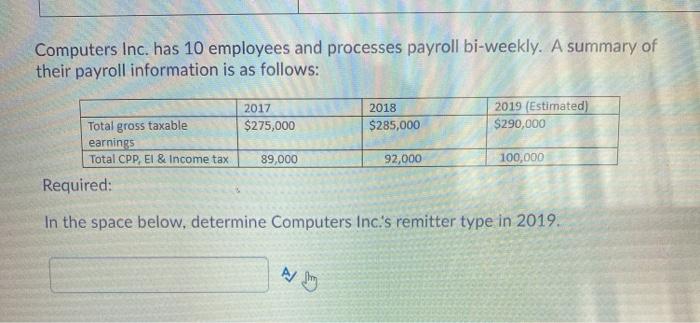

Question 1 (1 point) Remitter type Average monthly withholding amount (AMWA) Quarterly remitters - new small employers Not based on AMWA. The monthly withholding amount is zero to $999,99 and the employer has a perfect compliance history.* Quarterly remitters - account opened for 12 months or longer Under $3,000, and the employer has a perfect compliance history. Regular remitters Under $25,000 Threshold 1 accelerated remitters From $25,000.00 to $99,999.99 Threshold 2 accelerated remitters $100,000.00 or more Computers Inc. has 10 employees and processes payroll bi-weekly. A summary of their payroll information is as follows: 2017 $275,000 2018 $285,000 2019 (Estimated) $290,000 Total gross taxable earnings Total CPP, El & Income tax Required: 89,000 92,000 100,000 In the space below, determine Computers Inc's remitter type in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts