Question: Question 1 (1 point) Saved How can a firm use FRA to hedge a receivable at a future date Ty to guarantee the investment return

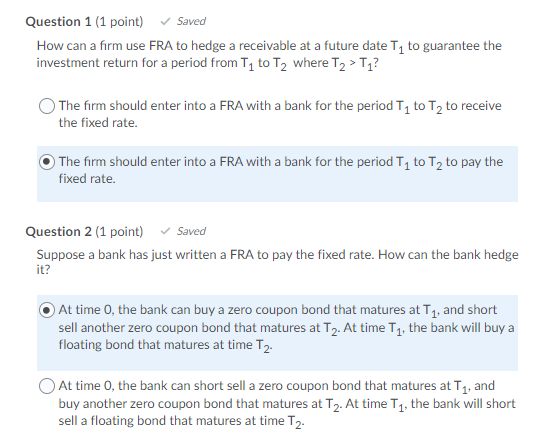

Question 1 (1 point) Saved How can a firm use FRA to hedge a receivable at a future date Ty to guarantee the investment return for a period from T1 to T2 where T2 > T1? The firm should enter into a FRA with a bank for the period T4 to T2 to receive the fixed rate. The firm should enter into a FRA with a bank for the period T1 to Ty to pay the fixed rate. Saved Question 2 (1 point) Suppose a bank has just written a FRA to pay the fixed rate. How can the bank hedge it? At time 0, the bank can buy a zero coupon bond that matures at T1, and short sell another zero coupon bond that matures at T2. At time T1, the bank will buy a floating bond that matures at time T2. At time 0, the bank can short sell a zero coupon bond that matures at T1, and buy another zero coupon bond that matures at T2. At time T1, the bank will short sell a floating bond that matures at time T2. Question 1 (1 point) Saved How can a firm use FRA to hedge a receivable at a future date Ty to guarantee the investment return for a period from T1 to T2 where T2 > T1? The firm should enter into a FRA with a bank for the period T4 to T2 to receive the fixed rate. The firm should enter into a FRA with a bank for the period T1 to Ty to pay the fixed rate. Saved Question 2 (1 point) Suppose a bank has just written a FRA to pay the fixed rate. How can the bank hedge it? At time 0, the bank can buy a zero coupon bond that matures at T1, and short sell another zero coupon bond that matures at T2. At time T1, the bank will buy a floating bond that matures at time T2. At time 0, the bank can short sell a zero coupon bond that matures at T1, and buy another zero coupon bond that matures at T2. At time T1, the bank will short sell a floating bond that matures at time T2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts