Question: Question 1 (1 point) Saved On June 1, 2020, a company entered into a 2-year forward rate agreement (FRA) with a bank for the period

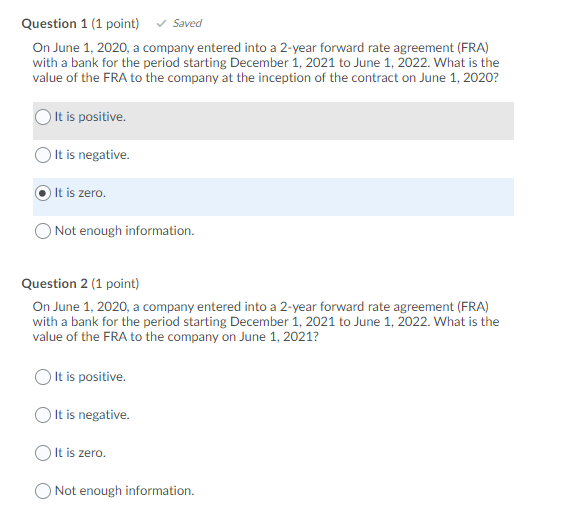

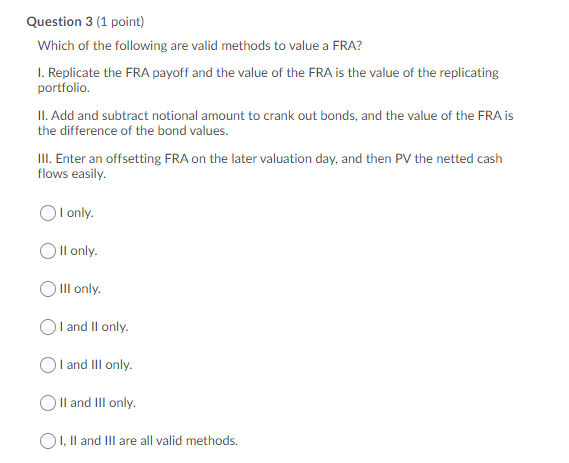

Question 1 (1 point) Saved On June 1, 2020, a company entered into a 2-year forward rate agreement (FRA) with a bank for the period starting December 1, 2021 to June 1, 2022. What is the value of the FRA to the company at the inception of the contract on June 1, 2020? It is positive. It is negative. It is zero. Not enough information. Question 2 (1 point) On June 1, 2020, a company entered into a 2-year forward rate agreement (FRA) with a bank for the period starting December 1, 2021 to June 1, 2022. What is the value of the FRA to the company on June 1, 2021? It is positive. It is negative. It is zero. Not enough information. Question 3 (1 point) Which of the following are valid methods to value a FRA? 1. Replicate the FRA payoff and the value of the FRA is the value of the replicating portfolio II. Add and subtract notional amount to crank out bonds, and the value of the FRA is the difference of the bond values. III. Enter an offsetting FRA on the later valuation day, and then PV the netted cash flows easily. OI only. Oll only. Olll only. I and II only. I and III only. II and III only. O I, II and III are all valid methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts