Question: Question 1 (1 point) Saved Suppose a company borrows $1 million debt to invest in a project that generates uncertain future cash flow (revenue) of

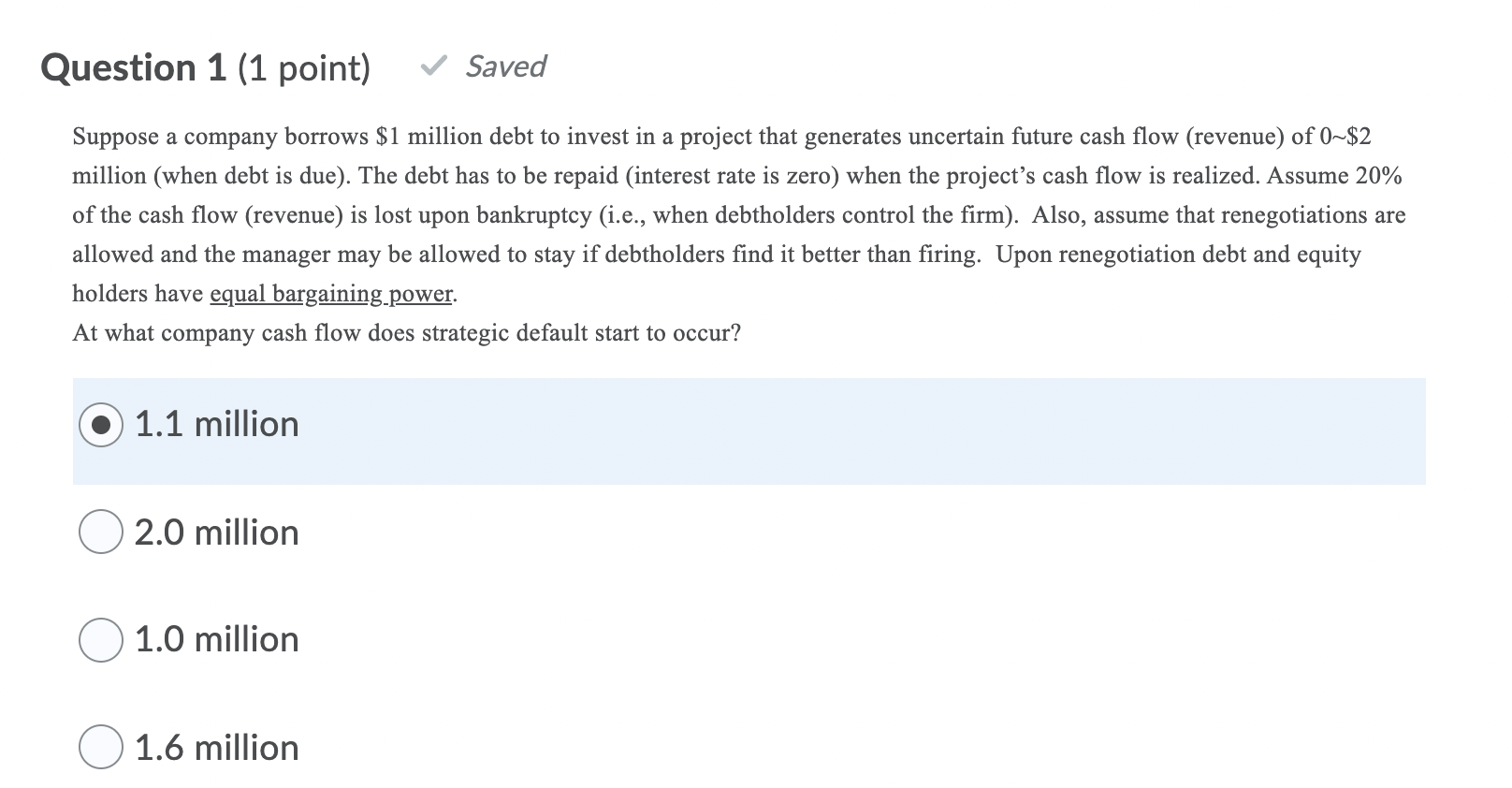

Question 1 (1 point) Saved Suppose a company borrows $1 million debt to invest in a project that generates uncertain future cash flow (revenue) of 0-$2 million (when debt is due). The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Assume 20% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Upon renegotiation debt and equity holders have equal bargaining.power. At what company cash flow does strategic default start to occur? 1.1 million 2.0 million 1.0 million 1.6 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts