Question: Question 1 (1 point) When a job has been completed, the goods are transferred from the production department to the finished goods warehouse and the

Question 1 (1 point)

When a job has been completed, the goods are transferred from the production department to the finished goods warehouse and the journal entry would include a credit to Work in Process.

Question 1 options:

| True | |

| False |

Question 2 (1 point)

Finished Goods are reported as an:

Question 2 options:

| expense on the income statement | |

| item on both the balance sheet and the income statement | |

| expense on the balance sheet | |

| asset on the income statement | |

| asset on the balance sheet |

Question 3 (1 point)

A commercial aircraft manufacturer would use a _____ costing system.

Question 3 options:

| job order | |

| process |

Question 4 (1 point)

A process costing system:

Question 4 options:

| uses a separate Work in Process account for each processing department. | |

| uses a single Work in Process account for the entire company. | |

| uses a separate Work in Process account for each type of product produced. | |

| does not use a Work in Process account in any form. |

Question 5 (1 point)

In a process costing system, manufacturing overhead applied is usually recorded as a debit to:

Question 5 options:

| Finished goods. | |

| Work in process. | |

| Manufacturing overhead. | |

| Cost of goods sold. |

Question 6 (1 point)

Variable costing and absorption costing net incomes may not be the same. If they are different, the amount of difference can be reconciled by analyzing the changes made to the inventory account during the period.

Question 6 options:

| True | |

| False |

Question 7 (1 point)

Total variable costs:

Question 7 options:

| remain constant, regardless of the level of production | |

| increase as production increases | |

| decrease as production increases |

Question 8 (1 point)

Manufacturing overhead combined with direct materials is known as conversion cost.

Question 8 options:

| True | |

| False |

Question 9 (1 point)

Which of the following is not one of the three basic activities of a manager?

Question 9 options:

| Planning | |

| Controlling | |

| Decision making | |

| Compiling management accounting reports |

Question 10 (1 point)

Which branch of accounting emphasizes relevance and timeliness?

Question 10 options:

| financial accounting | |

| managerial accounting |

Question 11 (1 point)

Which branch of accounting is more concerned with decisions affecting the future?

Question 11 options:

| financial accounting | |

| managerial accounting |

Question 12 (1 point)

Shipping costs would be classified as _____.

Question 12 options:

| direct material | |

| direct labor | |

| manufacturing overhead | |

| selling expense | |

| administrative expense |

Question 13 (1 point)

Underapplied or overapplied manufacturing overhead represents the difference between actual overhead costs and applied overhead costs.

Question 13 options:

| True | |

| False |

Question 14 (1 point)

Actual manufacturing overhead costs are traced to specific jobs.

Question 14 options:

| True | |

| False |

Question 15 (1 point)

Depreciation of the factory would be classified as _____.

Question 15 options:

| direct material | |

| direct labor | |

| manufacturing overhead | |

| selling expense | |

| administrative expense |

Question 16 (1 point)

Under variable costing, product cost contains some fixed manufacturing overhead cost.

Question 16 options:

| True | |

| False |

Question 17 (1 point)

Finished Goods is the account used to:

Question 17 options:

| record the value of the goods available for sale | |

| accumulate product costs while the units are in production | |

| record the costs associated with the goods that were finished during the period | |

| record the manufacturing costs associated with the units that were sold during the period | |

| record the revenue earned from the sale of goods during the period |

Question 18 (1 point)

Which branch of accounting reports on segments of the company (i.e. product lines, geographic locations, departments, etc.)?

Question 18 options:

| financial accounting | |

| managerial accounting |

Question 19 (1 point)

An accounting firm would use a _____ costing system.

Question 19 options:

| job order | |

| process |

Question 20 (1 point)

Contribution margin is the excess of revenues over:

Question 20 options:

| cost of goods sold. | |

| manufacturing cost. | |

| all direct costs. | |

| all variable costs. |

Question 21 (1 point)

Variable costing is a costing method that is designed to provide managers with product cost information for external financial reports.

Question 21 options:

| True | |

| False |

Question 22 (1 point)

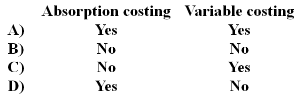

Fixed manufacturing overhead is included in product costs under:

Question 22 options:

| Option A | |

| Option B | |

| Option C | |

| Option D |

Question 23 (1 point)

Work in Process (WIP) is reported as an:

Question 23 options:

| asset on the balance sheet | |

| asset on the income statement | |

| expense on the income statement | |

| item on both the balance sheet and the income statement | |

| expense on the balance sheet |

Question 24 (1 point)

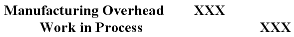

The following journal entry would be made to apply overhead cost to jobs in a job-order costing system:

Question 24 options:

| True | |

| False |

Question 25 (1 point)

Direct materials would be classified as a _____ cost.

Question 25 options:

| product | |

| period |

Question 26 (1 point)

A debit balance in the Manufacturing Overhead account at the end of the year means that manufacturing overhead is overapplied.

Question 26 options:

| True | |

| False |

Question 27 (1 point)

Direct material cost combined with manufacturing overhead cost is known as conversion cost.

Question 27 options:

| True | |

| False |

Question 28 (1 point)

A contribution format income statement is used primarily for _____.

Question 28 options:

| external reporting | |

| internal decision making |

Question 29 (1 point)

Manufacturing overhead:

Question 29 options:

| can be either a variable cost or a fixed cost. | |

| includes the costs of shipping finished goods to customers. | |

| includes all factory labor costs. | |

| includes all fixed costs. |

Question 30 (1 point)

Overapplied manufacturing overhead occurs when:

Question 30 options:

| applied overhead exceeds actual overhead. | |

| actual overhead exceeds applied overhead. | |

| applied overhead exceeds estimated overhead. | |

| actual overhead exceeds estimated overhead. |

Question 31 (1 point)

Which of the following is the correct formula to compute the predetermined overhead rate?

Question 31 options:

| Estimated total units in the allocation base divided by estimated total manufacturing overhead costs. | |

| Estimated total manufacturing overhead costs divided by estimated total units in the allocation base. | |

| Actual total manufacturing overhead costs divided by estimated total units in the allocation base. | |

| Estimated total manufacturing overhead costs divided by actual total units in the allocation base. |

Question 32 (1 point)

A traditional format income statement emphasizes _____.

Question 32 options:

| cost behavior (fixed vs. variable) | |

| cost type (product vs. period) |

Question 33 (1 point)

What is the cause of the difference between absorption costing net operating income and variable costing net operating income?

Question 33 options:

| Absorption costing deducts all manufacturing costs from net operating income; variable costing deducts only prime costs. | |

| Absorption costing allocates fixed manufacturing costs between cost of goods sold and inventories; variable costing considers all fixed manufacturing costs to be period costs. | |

| Absorption costing includes variable manufacturing costs in product costs; variable costing considers variable manufacturing costs to be period costs. | |

| Absorption costing includes fixed administrative costs in product costs; variable costing considers fixed administrative costs to be period costs. |

Question 34 (1 point)

A management consulting firm would use a _____ costing system.

Question 34 options:

| job order | |

| process |

Question 35 (1 point)

When production is equal to sales, net operating income reported under variable costing will be:

Question 35 options:

| equal to net operating income reported under absorption costing | |

| less than net income reported under absorption costing | |

| greater than net operating income reported under absorption costing |

\begin{tabular}{lcc} & Absorption costing & Variable costing \\ A) & Yes & Yes \\ B) & No & No \\ C) & No & Yes \\ D) & Yes & No \end{tabular} Manufacturing Overhead XXX Work in Process XXX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts