Question: Question 1 1 points Save Answer (CHAPTER 14) Cal Poly Corporation would like to start a new project building a high-tech rose float for the

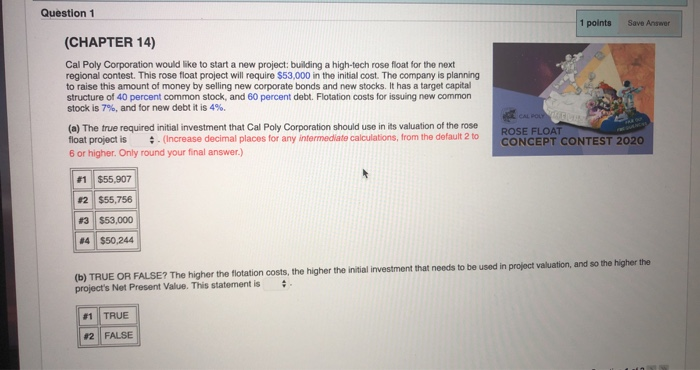

Question 1 1 points Save Answer (CHAPTER 14) Cal Poly Corporation would like to start a new project building a high-tech rose float for the next regional contest. This rose float project will require $53,000 in the initial cost. The company is planning to raise this amount of money by selling new corporate bonds and new stocks. It has a target capital structure of 40 percent common stock, and 60 percent debt. Flotation costs for issuing new common stock is 7%, and for new debt it is 4%. (a) The true required initial investment that Cal Poly Corporation should use in its valuation of the rose float project is increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer.) CALPOO ROSE FLOAT CONCEPT CONTEST 2020 1 $55,907 12 $55,756 13 $53,000 14 $50,244 (1) TRUE OR FALSE? The higher the flotation costs, the higher the initial investment that needs to be used in project valuation, and so the higher the project's Net Present Value. This statement is TRUE 12 FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts