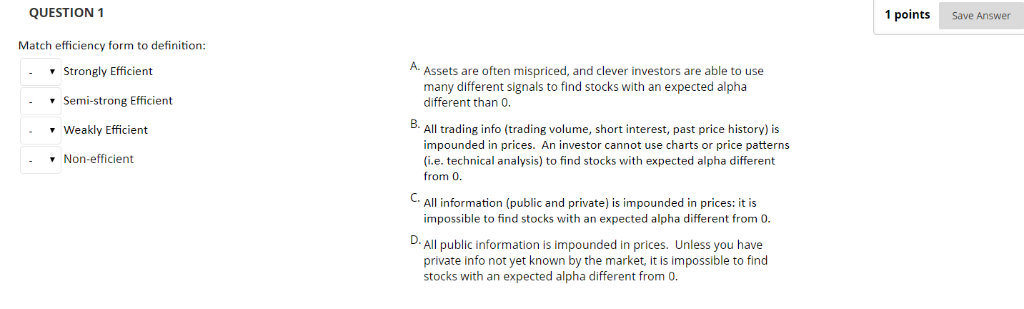

Question: QUESTION 1 1 points Save Answer Match efficiency form to definition A. Assets are often mispriced, and clever investors are able to use Strongly Efficient

QUESTION 1 1 points Save Answer Match efficiency form to definition A. Assets are often mispriced, and clever investors are able to use Strongly Efficient Semi-strong Efficient Weakly Efficient Non-efficient many different signals to find stocks with an expected alpha different than 0. 8. All trading info (trading volume, short interest, past price history) is impounded in prices. An investor cannot use charts or price patterns (i.e. technical analysis) to find stocks with expected alpha different from 0. All information (public and private) is impounded in prices: it is impossible to find stocks with an expected alpha different from 0. D. All public information is impounded in prices. Unless you have private info not yet known by the market, it is impossible to find stocks with an expected alpha different from 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts