Question: Question 1 1 points Save Answer Mr. S is a trader who trades in securities market. He always carns a risk-free profit over the period

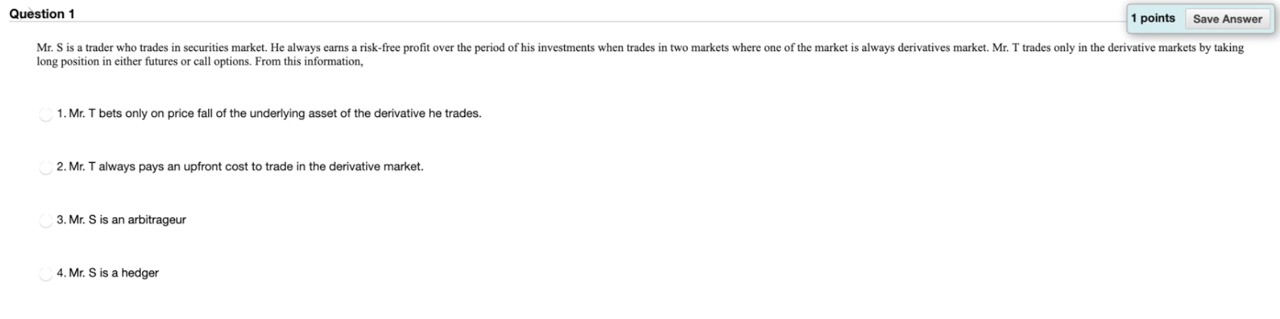

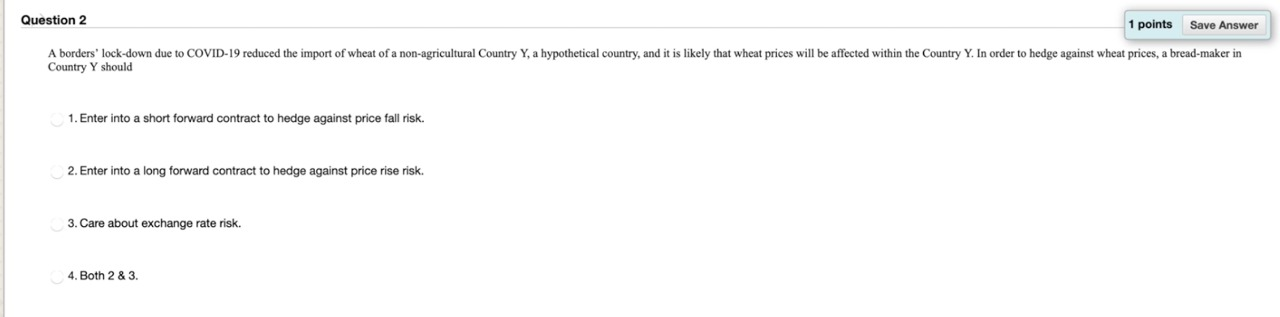

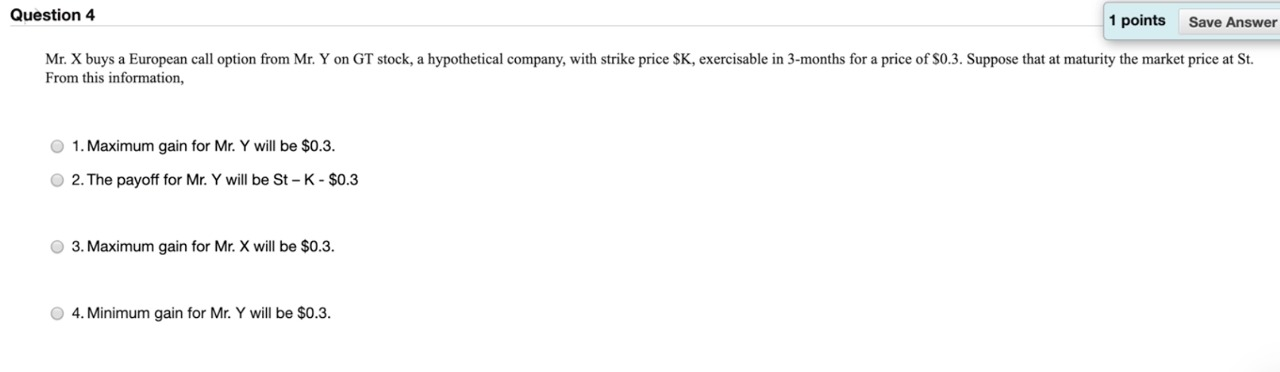

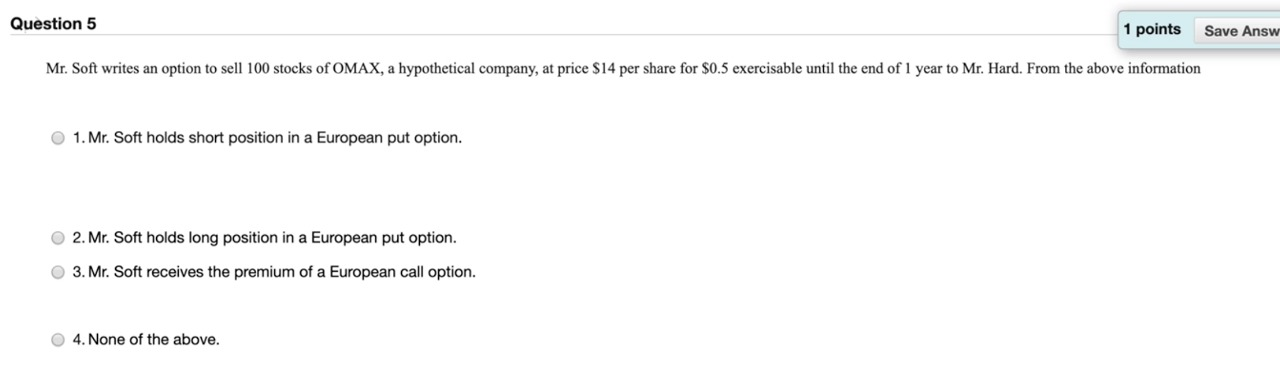

Question 1 1 points Save Answer Mr. S is a trader who trades in securities market. He always carns a risk-free profit over the period of his investments when trades in two markets where one of the market is always derivatives market. Mr. T trades only in the derivative markets by taking long position in either futures or call options. From this information, 1. Mr. T bets only on price fall of the underlying asset of the derivative he trades. 2. Mr. T always pays an upfront cost to trade in the derivative market. 3. Mr. S is an arbitrageur 4. Mr. S is a hedger Question 2 1 points Save Answer A borders' lock-down due to COVID-19 reduced the import of wheat of a non-agricultural Country Y, a hypothetical country, and it is likely that wheat prices will be affected within the Country Y. In order to hedge against wheat prices, a bread-maker in Country Y should 1. Enter into short forward contract to hedge against price fall risk. 2. Enter into a long forward contract to hedge against price rise risk. 3. Care about exchange rate risk. 4. Both 2 & 3 Question 3 Same investments in safe asset usually produces a return than investments in a risky asset 1. Higher 2. Lower 3. Equal 4. None of the above Question 4 1 points Save Answer Mr. X buys a European call option from Mr. Y on GT stock, a hypothetical company, with strike price $K, exercisable in 3-months for a price of $0.3. Suppose that at maturity the market price at St. From this information, 1. Maximum gain for Mr. Y will be $0.3. 2. The payoff for Mr. Y will be St-K - $0.3 3. Maximum gain for Mr.X will be $0.3. 4. Minimum gain for Mr. Y will be $0.3. Question 5 1 points Save Answ Mr. Soft writes an option to sell 100 stocks of OMAX, a hypothetical company, at price $14 per share for $0.5 exercisable until the end of 1 year to Mr. Hard. From the above information 1. Mr. Soft holds short position in a European put option. 2. Mr. Soft holds long position in a European put option. 3. Mr. Soft receives the premium of a European call option. 4. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts