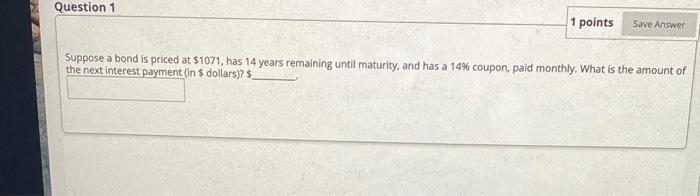

Question: Question 1 1 points Save Answer Suppose a bond is priced at $1071, has 14 years remaining until maturity, and has a 14% coupon, paid

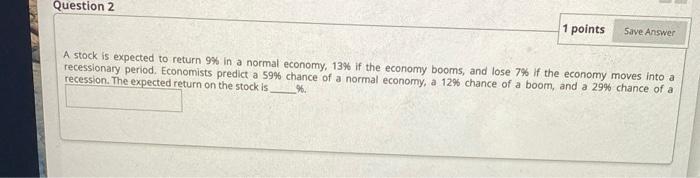

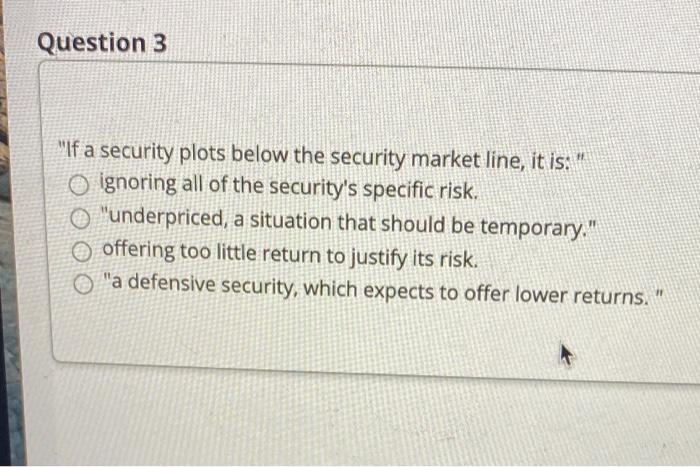

Question 1 1 points Save Answer Suppose a bond is priced at $1071, has 14 years remaining until maturity, and has a 14% coupon, paid monthly. What is the amount of the next interest payment (in $ dollars)? $_ Question 2 1 points Save Answer A stock is expected to return 9% in a normal economy, 13% if the economy booms, and lose 7% if the economy moves into a recessionary period. Economists predict a 59% chance of a normal economy, a 12% chance of a boom, and a 29% chance of a recession. The expected return on the stock is Question 3 "If a security plots below the security market line, it is." o ignoring all of the security's specific risk. O "underpriced, a situation that should be temporary." o offering too little return to justify its risk. "a defensive security, which expects to offer lower returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts