Question: Question 1 1 pts Alpha Enterprises, Inc. has a WACC of 14.50% and is considering a project that requires a cash outlay of S2,150 now

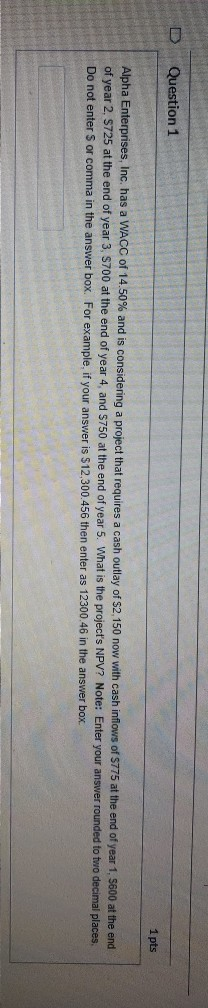

Question 1 1 pts Alpha Enterprises, Inc. has a WACC of 14.50% and is considering a project that requires a cash outlay of S2,150 now with cash inflows of S775 at the end of year 1, 8600 at the end of year 2, S725 at the end of year 3, S700 at the end of year 4, and $750 at the end of year 5. What is the project's NPV? Note: Enter your answer rounded to two decimal places Do not enter S or comma in the answer box. For example, if your answer is $12,300.456 then enter as 12300.46 in the answer box

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock