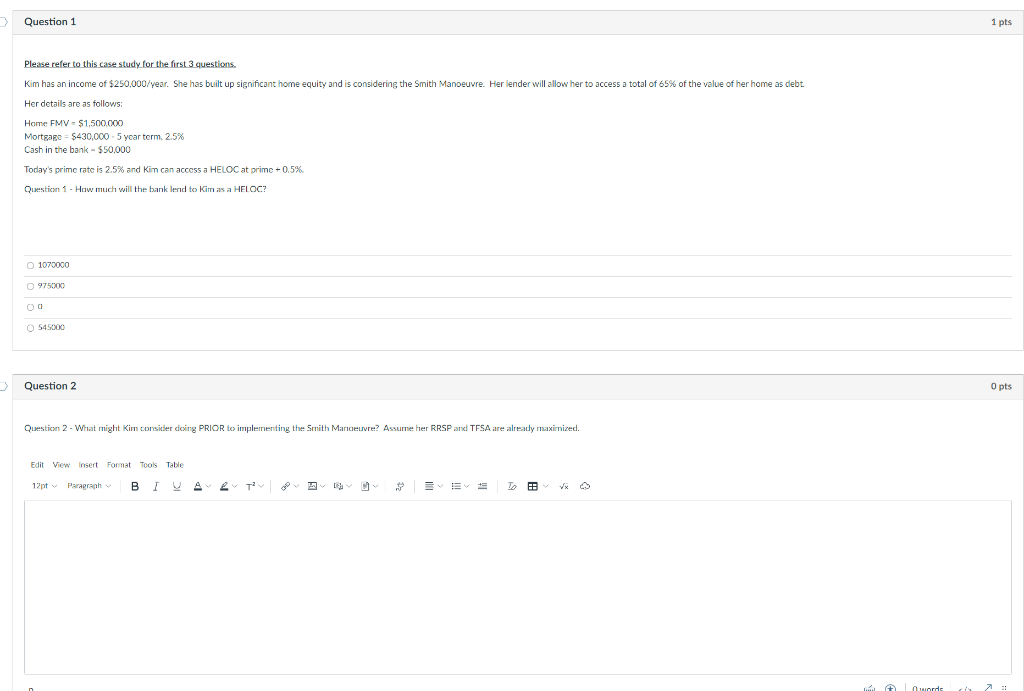

Question: Question 1 1 pts Please refer to this case study for the first 3 questions. Kim has an income of $250.000/year. She has built up

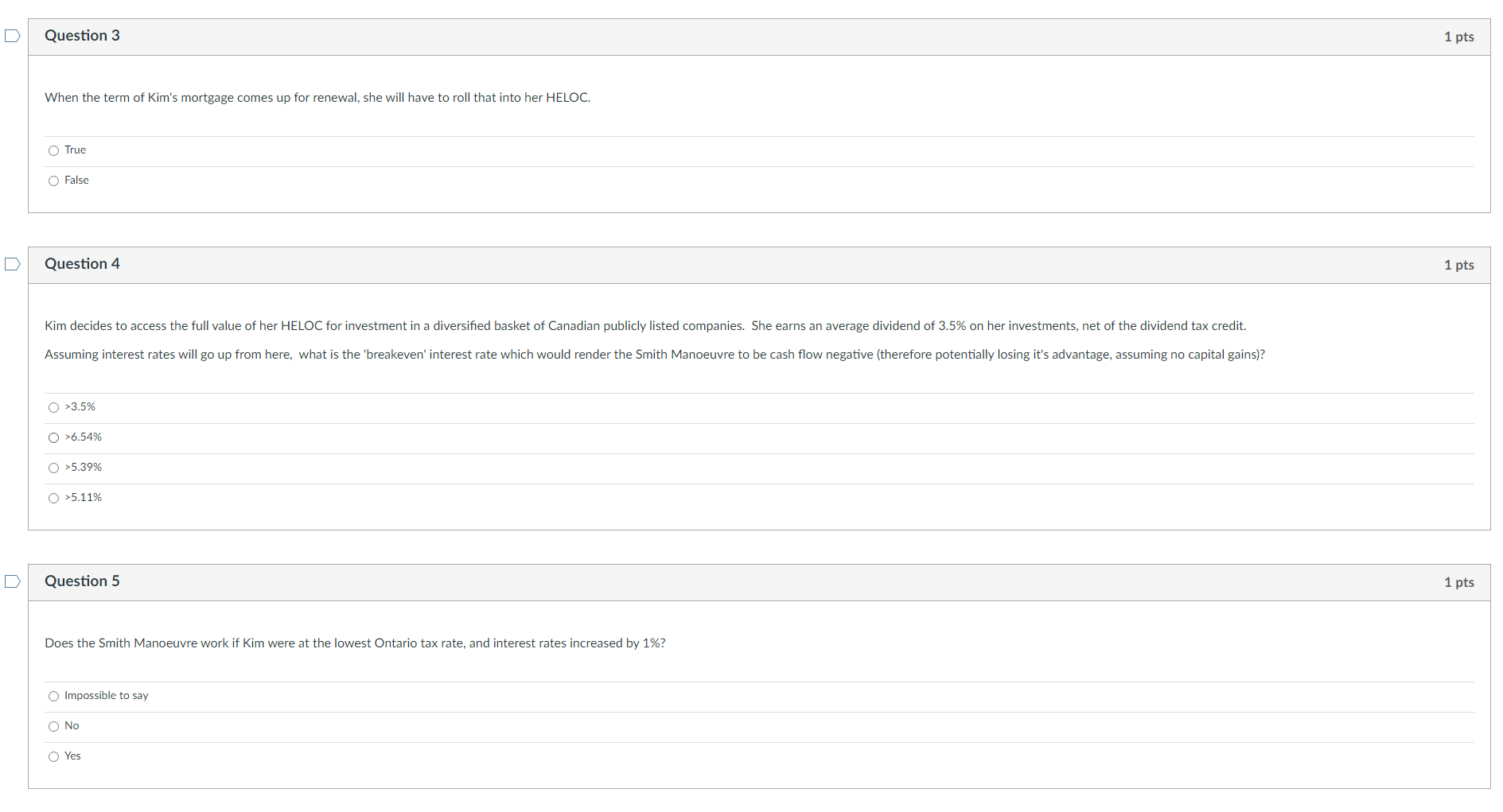

Question 1 1 pts Please refer to this case study for the first 3 questions. Kim has an income of $250.000/year. She has built up significant home equity and is considering the Smith Manoeuvre. Her lender will allow her to access a total of 65% of the value of her home as debt Her details are as follows: Home FMV - $1,500,000 Mortgage = $430,000 - 5 year term, 2.5% Cash in the bank - $50,000 Today's prime rate is 2.5% and Kim can access a HELOC at prime +0.5% Question 1 - How much will the bank lend to Kim as a HELOC? 1070000 0975500 545000 Question 2 O pts Question 2 - What might Kim consider coing PRIOR to implementing the Smith Marcevre? Assume her RRSP and TFSA are already maxirnized. Edit View Insert Format Tools Table 12ptParagraph B 1 words Question 3 1 pts When the term of Kim's mortgage comes up for renewal, she will have to roll that into her HELOC. True O False Question 4 1 pts Kim decides to access the full value of her HELOC for investment in a diversified basket of Canadian publicly listed companies. She earns an average dividend of 3.5% on her investments, net of the dividend tax credit. Assuming interest rates will go up from here, what is the 'breakeven' interest rate which would render the Smith Manoeuvre to be cash flow negative (therefore potentially losing it's advantage, assuming no capital gains)? O >3.5% O >6.54% O >5.39% O >5.11% Question 5 1 pts Does the Smith Manoeuvre work if Kim were at the lowest Ontario tax rate, and interest rates increased by 1%? O ible to say Yes Question 1 1 pts Please refer to this case study for the first 3 questions. Kim has an income of $250.000/year. She has built up significant home equity and is considering the Smith Manoeuvre. Her lender will allow her to access a total of 65% of the value of her home as debt Her details are as follows: Home FMV - $1,500,000 Mortgage = $430,000 - 5 year term, 2.5% Cash in the bank - $50,000 Today's prime rate is 2.5% and Kim can access a HELOC at prime +0.5% Question 1 - How much will the bank lend to Kim as a HELOC? 1070000 0975500 545000 Question 2 O pts Question 2 - What might Kim consider coing PRIOR to implementing the Smith Marcevre? Assume her RRSP and TFSA are already maxirnized. Edit View Insert Format Tools Table 12ptParagraph B 1 words Question 3 1 pts When the term of Kim's mortgage comes up for renewal, she will have to roll that into her HELOC. True O False Question 4 1 pts Kim decides to access the full value of her HELOC for investment in a diversified basket of Canadian publicly listed companies. She earns an average dividend of 3.5% on her investments, net of the dividend tax credit. Assuming interest rates will go up from here, what is the 'breakeven' interest rate which would render the Smith Manoeuvre to be cash flow negative (therefore potentially losing it's advantage, assuming no capital gains)? O >3.5% O >6.54% O >5.39% O >5.11% Question 5 1 pts Does the Smith Manoeuvre work if Kim were at the lowest Ontario tax rate, and interest rates increased by 1%? O ible to say Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts