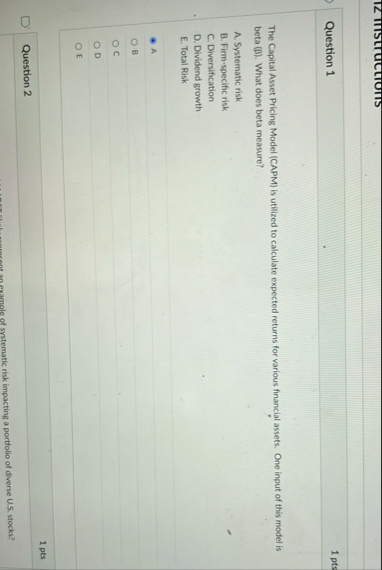

Question: Question 1 1 pts The Capital Asset Pricing Model ( CAPM ) is utilized to calculate expected returns for various financial assets. One input of

Question

pts

The Capital Asset Pricing Model CAPM is utilized to calculate expected returns for various financial assets. One input of this model is beta What does beta measure?

A Systematic risk

B Firmspecific risk

C Diversification

D Dividend growth

E Total Risk

A

c

E

pts

Question

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock