Question: Question 1 1 pts Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? WACC:

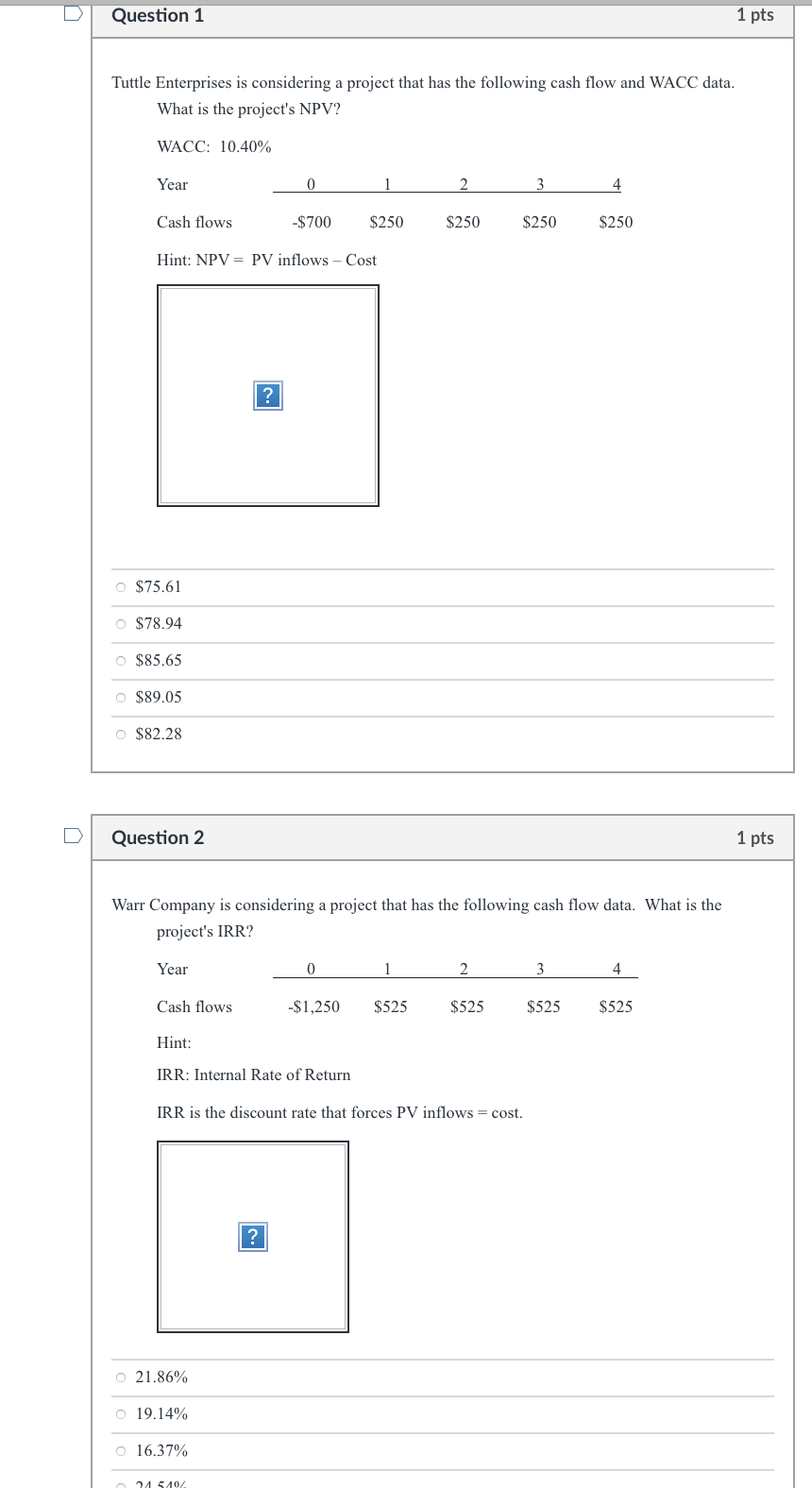

Question 1 1 pts Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? WACC: 10.40% Year 0 2 4 Cash flows -$700 $250 $250 $250 $250 Hint: NPV = PV inflows - Cost ? $75.61 O $78.94 O $85.65 O $89.05 O $82.28 Question 2 1 pts Warr Company is considering a project that has the following cash flow data. What is the project's IRR? Year 0 4 Cash flows -$1,250 $525 $525 $525 $525 Hint: IRR: Internal Rate of Return IRR is the discount rate that forces PV inflows = cost. ? 21.86% O 19.14% O 16.37% 24 540%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts