Question: Question 1 1 pts You are analyzing Field Technologies, Inc. From their financial statements and industry research, you have gathered information below. What would you

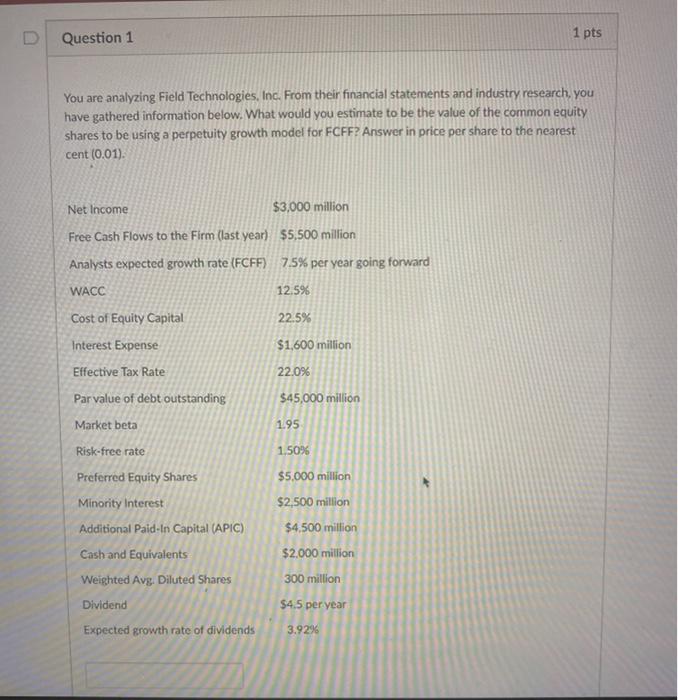

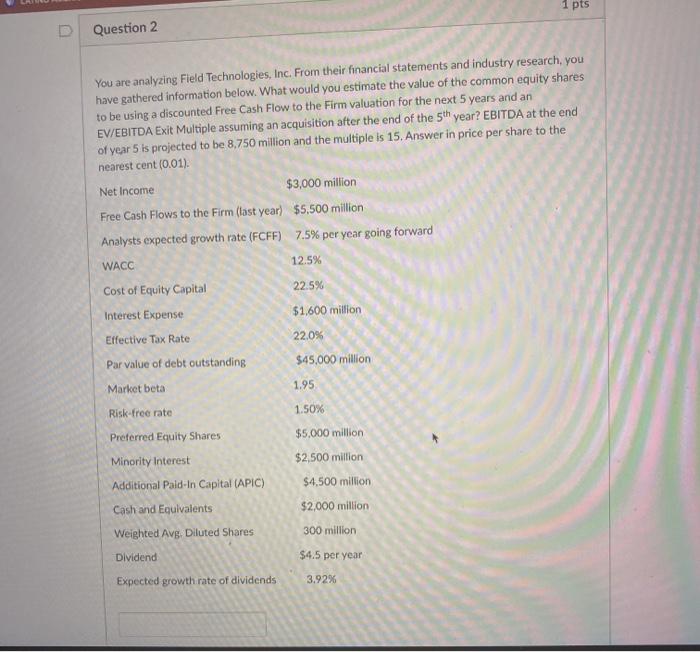

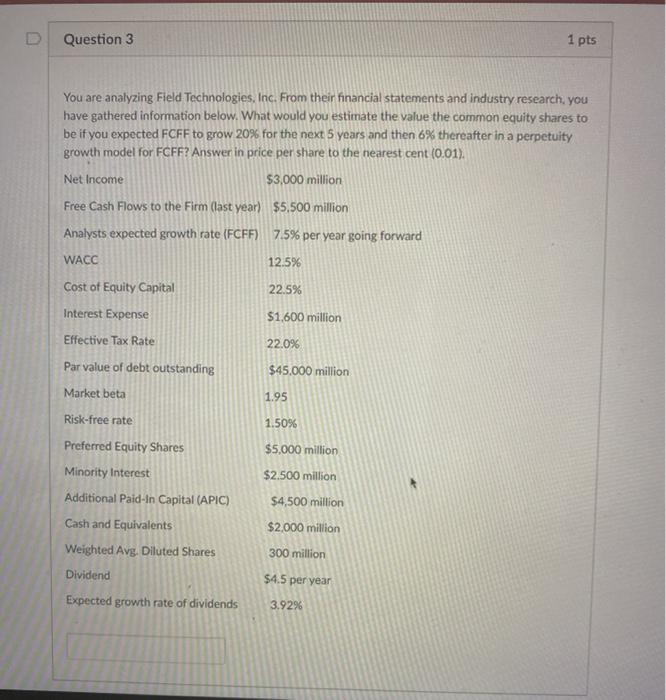

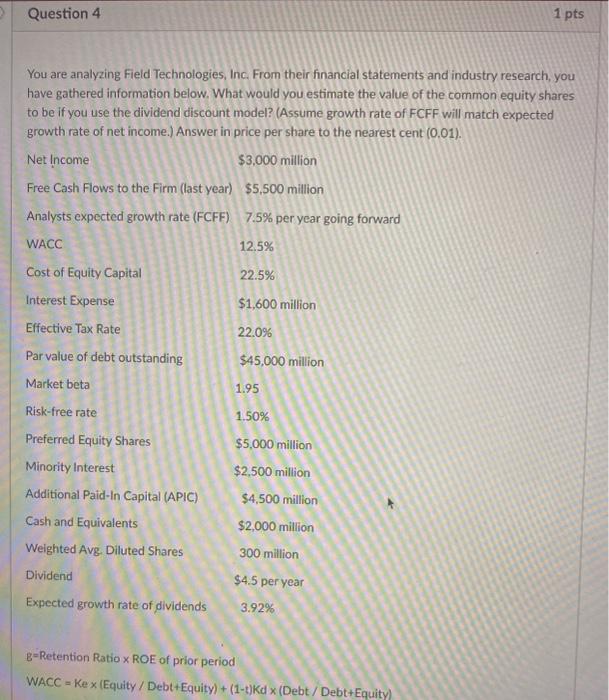

Question 1 1 pts You are analyzing Field Technologies, Inc. From their financial statements and industry research, you have gathered information below. What would you estimate to be the value of the common equity shares to be using a perpetuity growth model for FCFF? Answer in price per share to the nearest cent (0.01). Net Income $3,000 million Free Cash Flows to the Firm (last year) $5,500 million Analysts expected growth rate (FCFF) 7.5% per year going forward WACC 12.596 22.5% $1,600 million 22.0% $45,000 million 1.95 1.50% Cost of Equity Capital Interest Expense Effective Tax Rate Par value of debt outstanding Market beta Risk-free rate Preferred Equity Shares Minority interest Additional Paid-In Capital (APIC) Cash and Equivalents Weighted Avg. Diluted Shares Dividend Expected growth rate of dividends $5.000 million $2,500 million $4,500 million $2.000 million 300 million $4.5 per year 3.92% 1 pts D Question 2 You are analyzing Field Technologies, Inc. From their financial statements and industry research, you have gathered information below. What would you estimate the value of the common equity shares to be using a discounted Free Cash Flow to the Firm valuation for the next 5 years and an EV/EBITDA Exit Multiple assuming an acquisition after the end of the 5th year? EBITDA at the end of year 5 is projected to be 8,750 million and the multiple is 15. Answer in price per share to the nearest cent(0.01). Net Income $3,000 million Free Cash Flows to the Firm (last year) $5,500 million Analysts expected growth rate (FCFF) 7.5% per year going forward WACC 12.5% 22.5% Cost of Equity Capital Interest Expense $1,600 million Effective Tax Rate 22.0% Par value of debt outstanding $45.000 million Market beta 1.95 Risk-free rate 1.50% Preferred Equity Shares $5.000 million Minority Interest $2,500 million $4.500 million Additional Paid-In Capital (APIC) Cash and Equivalents $2,000 million Weighted Avg, Diluted Shares 300 million Dividend $4.5 per year Expected growth rate of dividends 3.92% Question 3 1 pts You are analyzing Field Technologies, Inc. From their financial statements and industry research, you have gathered information below. What would you estimate the value the common equity shares to be if you expected FCFF to grow 2096 for the next 5 years and then 6% thereafter in a perpetuity growth model for FCFF? Answer in price per share to the nearest cent (0.01), Net Income $3,000 million Free Cash Flows to the Firm (last year) $5,500 million Analysts expected growth rate (FCFF) 7.5% per year going forward WACC 12.5% Cost of Equity Capital 22.5% Interest Expense $1,600 million 22.0% Effective Tax Rate Par value of debt outstanding Market beta $45.000 million 1.95 Risk-free rate 1.50% $5,000 million $2.500 million Preferred Equity Shares Minority Interest Additional Paid-In Capital (APIC) Cash and Equivalents Weighted Avg. Diluted Shares Dividend Expected growth rate of dividends $4,500 million $2,000 million 300 million $4.5 per year 3.92% Question 4 1 pts You are analyzing Field Technologies, Inc. From their financial statements and industry research, you have gathered information below. What would you estimate the value of the common equity shares to be if you use the dividend discount model? (Assume growth rate of FCFF will match expected growth rate of net income.) Answer in price per share to the nearest cent (0.01). Net Income $3,000 million Free Cash Flows to the Firm (last year) $5.500 million Analysts expected growth rate (FCFF) 7.5% per year going forward WACC 12.5% Cost of Equity Capital 22.5% Interest Expense $1,600 million Effective Tax Rate 22.0% Par value of debt outstanding $45,000 million Market beta 1.95 Risk-free rate 1.50% Preferred Equity Shares $5,000 million Minority Interest $2,500 million Additional Paid-In Capital (APIC) $4,500 million Cash and Equivalents $2,000 million Weighted Avg. Diluted Shares 300 million Dividend $4.5 per year Expected growth rate of dividends 3.92% g-Retention Ratio x ROE of prior period WACC = Ke x (Equity / Debt+Equity) + (1-1)Kd x (Debt/Debt+Equity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts