Question: Question 1 1 pts Your client, Kevin, is deciding between just basic indemnity coverages (hospitalization, surgical and physician non-surgical coverage) or a major medical plan.

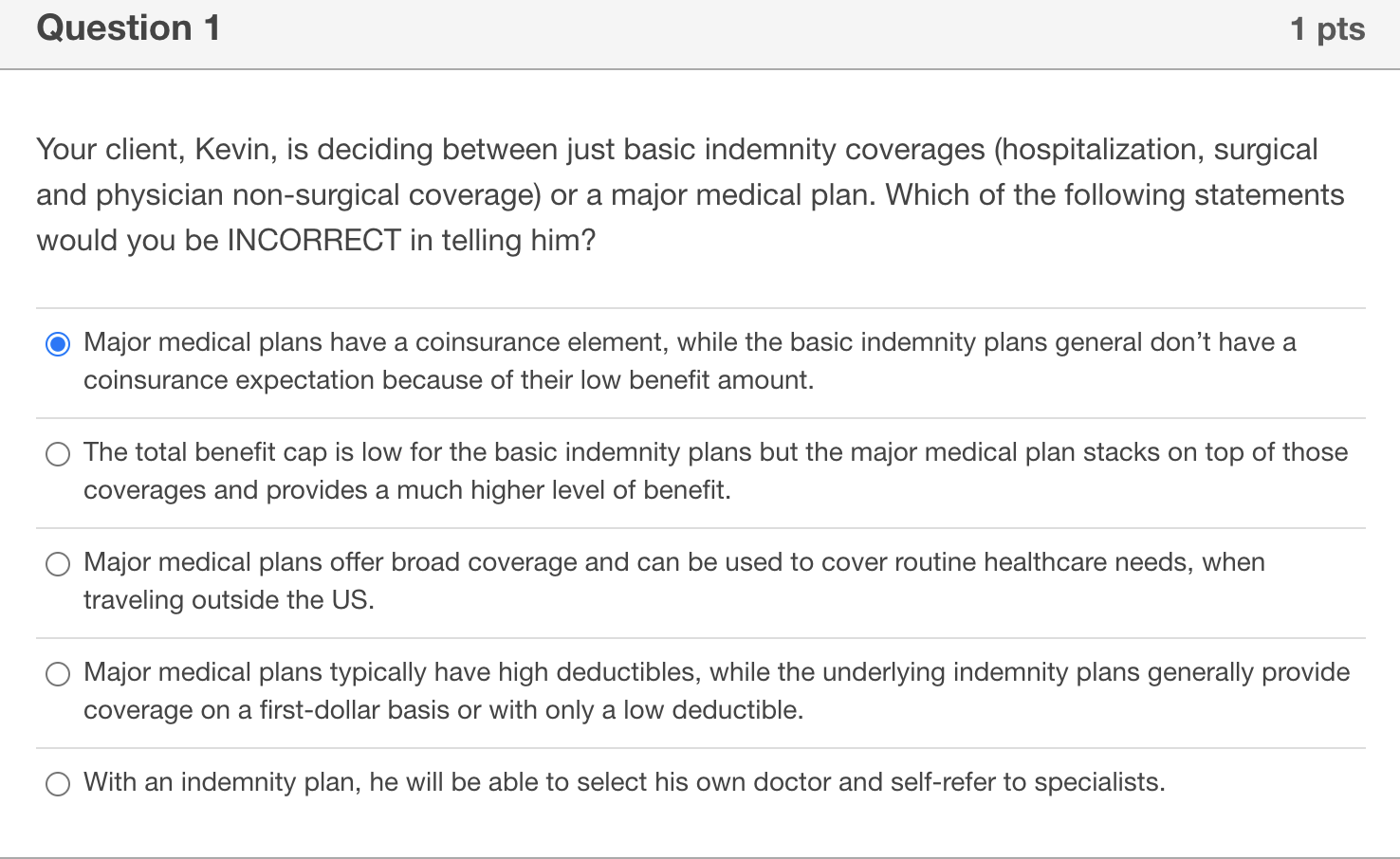

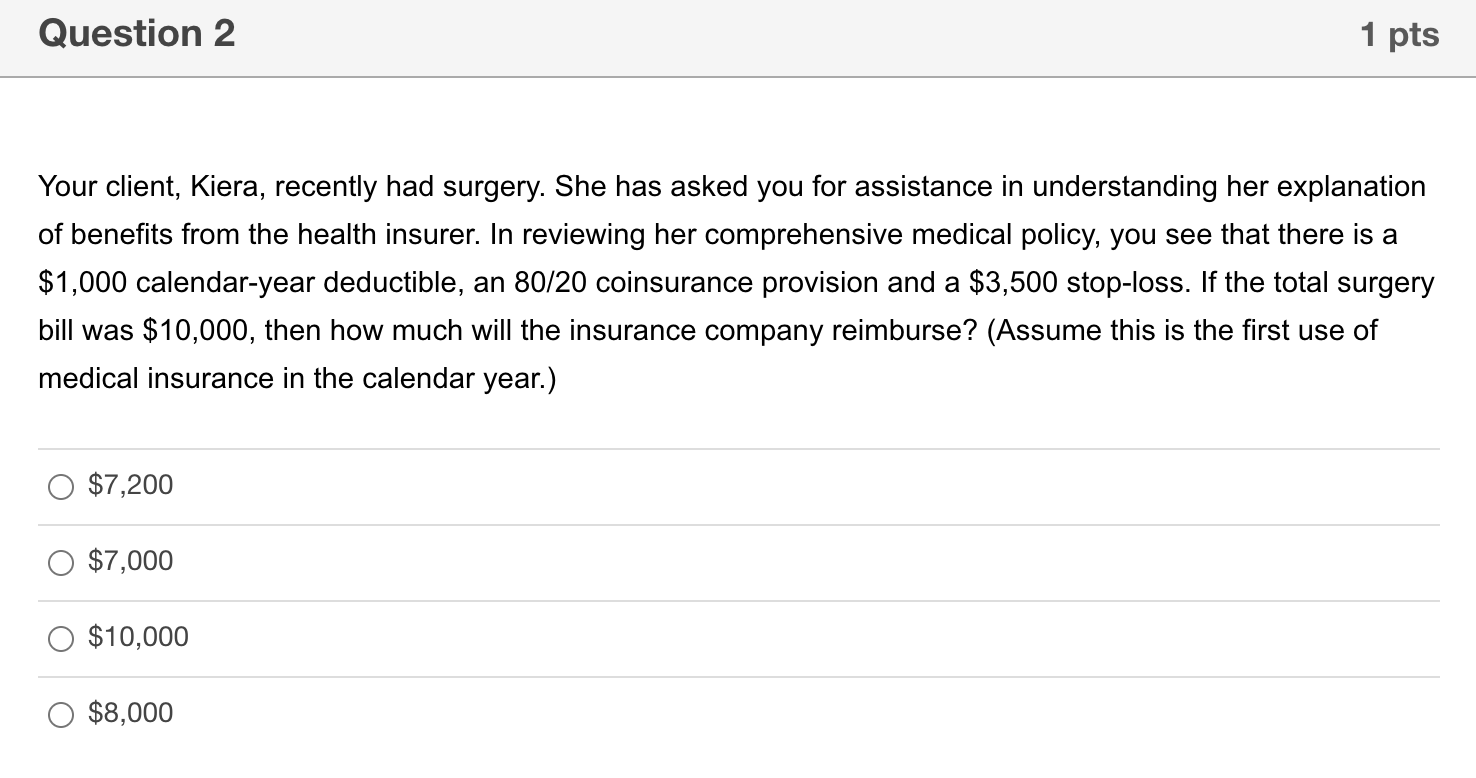

Question 1 1 pts Your client, Kevin, is deciding between just basic indemnity coverages (hospitalization, surgical and physician non-surgical coverage) or a major medical plan. Which of the following statements would you be INCORRECT in telling him? Major medical plans have a coinsurance element, while the basic indemnity plans general don't have a coinsurance expectation because of their low benefit amount. The total benefit cap is low for the basic indemnity plans but the major medical plan stacks on top of those coverages and provides a much higher level of benefit. O Major medical plans offer broad coverage and can be used to cover routine healthcare needs, when traveling outside the US. O Major medical plans typically have high deductibles, while the underlying indemnity plans generally provide coverage on a first-dollar basis or with only a low deductible. O With an indemnity plan, he will be able to select his own doctor and self-refer to specialists. Question 2 1 pts Your client, Kiera, recently had surgery. She has asked you for assistance in understanding her explanation of benefits from the health insurer. In reviewing her comprehensive medical policy, you see that there is a $1,000 calendar-year deductible, an 80/20 coinsurance provision and a $3,500 stop-loss. If the total surgery bill was $10,000, then how much will the insurance company reimburse? (Assume this is the first use of medical insurance in the calendar year.) $7,200 $7,000 $10,000 $8,000 Question 1 1 pts Your client, Kevin, is deciding between just basic indemnity coverages (hospitalization, surgical and physician non-surgical coverage) or a major medical plan. Which of the following statements would you be INCORRECT in telling him? Major medical plans have a coinsurance element, while the basic indemnity plans general don't have a coinsurance expectation because of their low benefit amount. The total benefit cap is low for the basic indemnity plans but the major medical plan stacks on top of those coverages and provides a much higher level of benefit. O Major medical plans offer broad coverage and can be used to cover routine healthcare needs, when traveling outside the US. O Major medical plans typically have high deductibles, while the underlying indemnity plans generally provide coverage on a first-dollar basis or with only a low deductible. O With an indemnity plan, he will be able to select his own doctor and self-refer to specialists. Question 2 1 pts Your client, Kiera, recently had surgery. She has asked you for assistance in understanding her explanation of benefits from the health insurer. In reviewing her comprehensive medical policy, you see that there is a $1,000 calendar-year deductible, an 80/20 coinsurance provision and a $3,500 stop-loss. If the total surgery bill was $10,000, then how much will the insurance company reimburse? (Assume this is the first use of medical insurance in the calendar year.) $7,200 $7,000 $10,000 $8,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts