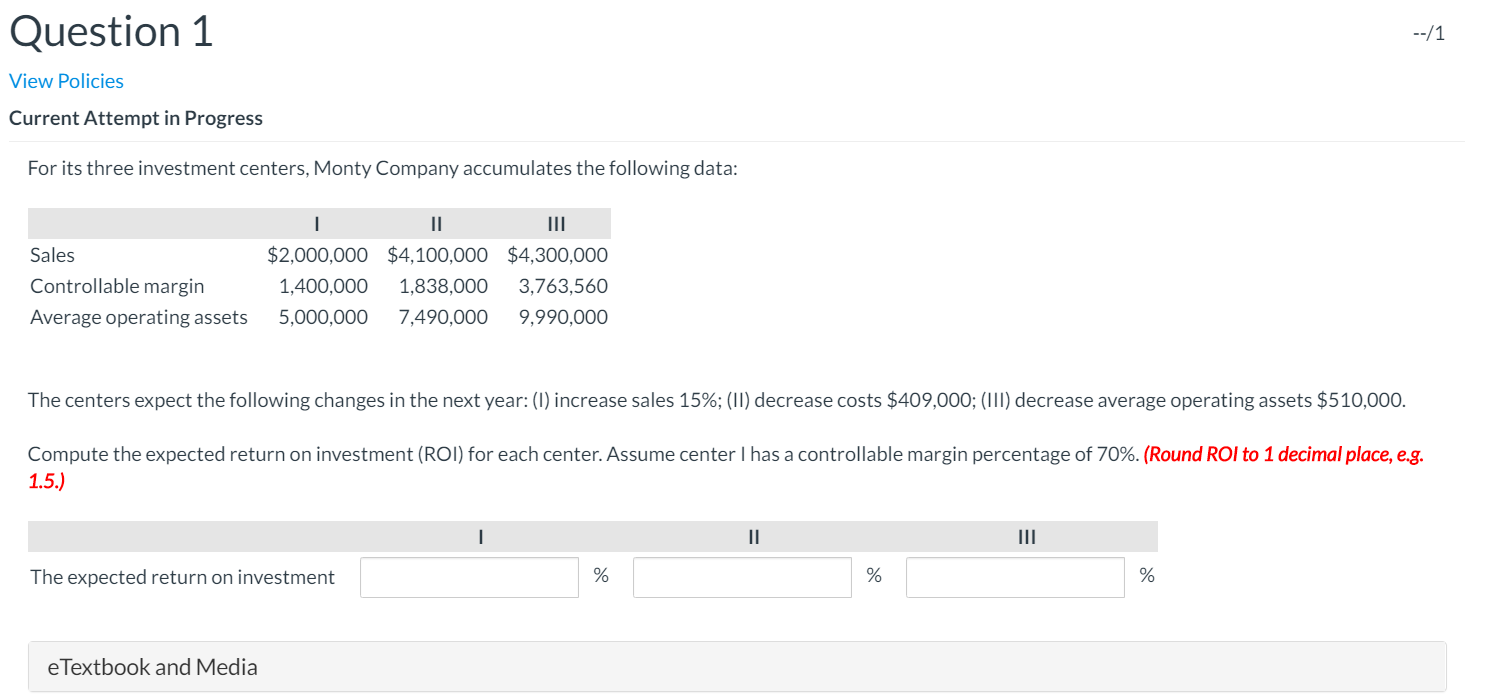

Question: Question 1 --/1 View Policies Current Attempt in Progress For its three investment centers, Monty Company accumulates the following data: Sales Controllable margin Average operating

Question 1 --/1 View Policies Current Attempt in Progress For its three investment centers, Monty Company accumulates the following data: Sales Controllable margin Average operating assets $2,000,000 1,400,000 5,000,000 $4,100,000 1,838,000 7,490,000 $4,300,000 3,763,560 9,990,000 The centers expect the following changes in the next year: (1) increase sales 15%; (II) decrease costs $409,000; (III) decrease average operating assets $510,000. Compute the expected return on investment (ROI) for each center. Assume center I has a controllable margin percentage of 70%. (Round ROI to 1 decimal place, e.g. 1.5.) The expected return on investment e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts