Question: QUESTION 1 1. What do you think should be reported by Islamic financial institutions in their annual report? Please justify your suggestions. (5 marks) 2.

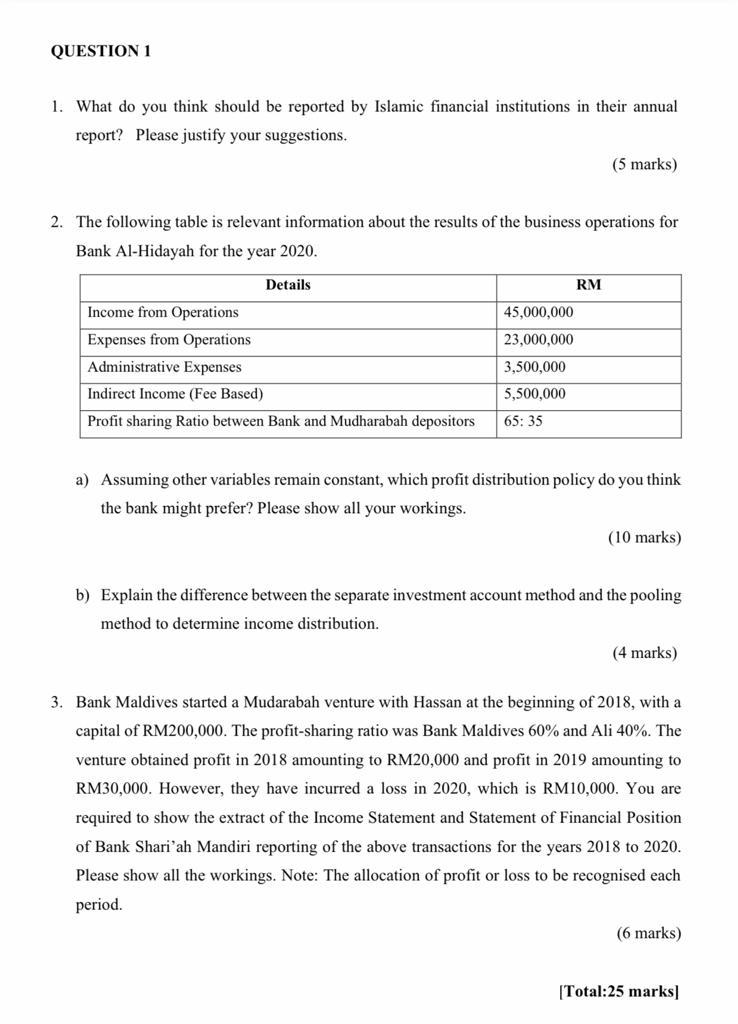

QUESTION 1 1. What do you think should be reported by Islamic financial institutions in their annual report? Please justify your suggestions. (5 marks) 2. The following table is relevant information about the results of the business operations for Bank Al-Hidayah for the year 2020. Details RM 45,000,000 23,000,000 Income from Operations Expenses from Operations Administrative Expenses Indirect Income (Fee Based) Profit sharing Ratio between Bank and Mudharabah depositors 3,500,000 5,500,000 65: 35 a) Assuming other variables remain constant, which profit distribution policy do you think the bank might prefer? Please show all your workings. (10 marks) b) Explain the difference between the separate investment account method and the pooling method to determine income distribution. (4 marks) 3. Bank Maldives started a Mudarabah venture with Hassan at the beginning of 2018, with a capital of RM200,000. The profit-sharing ratio was Bank Maldives 60% and Ali 40%. The venture obtained profit in 2018 amounting to RM20,000 and profit in 2019 amounting to RM30,000. However, they have incurred a loss in 2020, which is RM10,000. You are required to show the extract of the Income Statement and Statement of Financial Position of Bank Shari'ah Mandiri reporting of the above transactions for the years 2018 to 2020. Please show all the workings. Note: The of profit or loss to be recognised each period. (6 marks) [Total:25 marks) QUESTION 1 1. What do you think should be reported by Islamic financial institutions in their annual report? Please justify your suggestions. (5 marks) 2. The following table is relevant information about the results of the business operations for Bank Al-Hidayah for the year 2020. Details RM 45,000,000 23,000,000 Income from Operations Expenses from Operations Administrative Expenses Indirect Income (Fee Based) Profit sharing Ratio between Bank and Mudharabah depositors 3,500,000 5,500,000 65: 35 a) Assuming other variables remain constant, which profit distribution policy do you think the bank might prefer? Please show all your workings. (10 marks) b) Explain the difference between the separate investment account method and the pooling method to determine income distribution. (4 marks) 3. Bank Maldives started a Mudarabah venture with Hassan at the beginning of 2018, with a capital of RM200,000. The profit-sharing ratio was Bank Maldives 60% and Ali 40%. The venture obtained profit in 2018 amounting to RM20,000 and profit in 2019 amounting to RM30,000. However, they have incurred a loss in 2020, which is RM10,000. You are required to show the extract of the Income Statement and Statement of Financial Position of Bank Shari'ah Mandiri reporting of the above transactions for the years 2018 to 2020. Please show all the workings. Note: The of profit or loss to be recognised each period. (6 marks) [Total:25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts