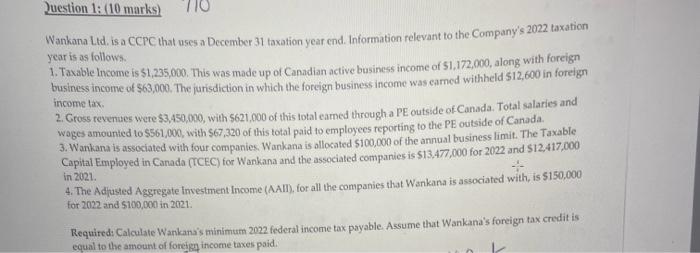

Question: Question 1: (10 marks) 710 Wankana Ltd. is a CCPC that uses a December 31 taxation year end. Information relevant to the Company's 2022 taxation

Wankana Ltd, is a CCPC that uses a December 31 taxation year end. Information relevant to the Company's 2022 taxation yearls as follows. 1. Taxable Income is $1,235,000. This was made up of Canadian active business income of 51,172,000, along with foreign business income of $63,000. The jurisdiction in which the forcign business income was eamed withheld $12,600 in foreign income tax. 2. Gross revenues were $3,450,000, with $621,000 of this total eamed through a PE cutside of Canada. Total salaries and wages amounted to $561,000, with $67,320 of this total paid to employees reporting to the PE outside of Canada. 3. Wankana is associated with four companies. Wankana is ollosated $100,000 of the annual business limit. The Taxable Capital Employed in Canada (TCEC) for Wankana and the associated comparies is $13,477,000 for 2022 and $12,417,000 in 2021 . 4. The Adfusted Aggregate investment Income (AAII), for all the companies that Wankana is associated with, is 5150,000 for 2022 and 5100,000 in 2021 . Requiredi Calculate Wankanas minimum 2022 federal income tax payable. Assume that Wankana's foreign tax credit is equal to the amount of foreigy income taxes poid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts