Question: Question 1 (10 marks) (a) Peter owned a 5-year bond A with a coupon rate of 6.6% p.a., paying coupon semi-annually and with a face

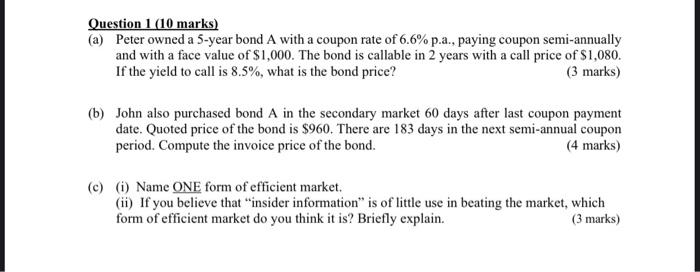

Question 1 (10 marks) (a) Peter owned a 5-year bond A with a coupon rate of 6.6% p.a., paying coupon semi-annually and with a face value of $1,000. The bond is callable in 2 years with a call price of $1,080. If the yield to call is 8.5%, what is the bond price? (3 marks) (b) John also purchased bond A in the secondary market 60 days after last coupon payment date. Quoted price of the bond is $960. There are 183 days in the next semi-annual coupon period. Compute the invoice price of the bond. (4 marks) (c) (i) Name ONE form of efficient market. (ii) If you believe that "insider information" is of little use in beating the market, which form of efficient market do you think it is? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts