Question: Question 1 (10 marks) A researcher has data on the daily percentage returns r; on the New York stock exchange index over the last 100

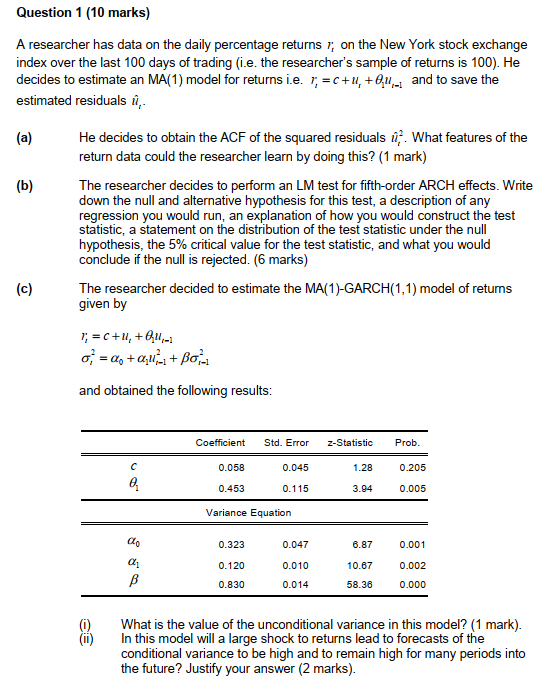

Question 1 (10 marks) A researcher has data on the daily percentage returns r; on the New York stock exchange index over the last 100 days of trading (i.e. the researcher's sample of returns is 100). He decides to estimate an MA(1) model for returns i.e. r; =C+4, +0.0,- and to save the estimated residuals ll (a) He decides to obtain the ACF of the squared residuals . What features of the return data could the researcher learn by doing this? (1 mark) (b) The researcher decides to perform an LM test for fifth-order ARCH effects. Write down the null and alternative hypothesis for this test, a description of any regression you would run, an explanation of how you would construct the test statistic, a statement on the distribution of the test statistic under the null hypothesis, the 5% critical value for the test statistic, and what you would conclude if the null is rejected. (6 marks) (c) ) The researcher decided to estimate the MA(1)-GARCH(1,1) model of returns given by 7; = C +1, +Que o = do +azua+ Bond and obtained the following results: Coefficient Std. Error z-Statistic Prob. 0.058 0.045 1.28 0.205 0.453 0.115 3.94 0.005 Variance Equation co 0.323 0.047 6.87 0.001 0.120 0.010 10.67 0.002 B 0.830 0.014 58.38 0.000 26 What is the value of the unconditional variance in this model? (1 mark). In this model will a large shock to returns lead to forecasts of the conditional variance to be high and to remain high for many periods into the future? Justify your answer (2 marks). Question 1 (10 marks) A researcher has data on the daily percentage returns r; on the New York stock exchange index over the last 100 days of trading (i.e. the researcher's sample of returns is 100). He decides to estimate an MA(1) model for returns i.e. r; =C+4, +0.0,- and to save the estimated residuals ll (a) He decides to obtain the ACF of the squared residuals . What features of the return data could the researcher learn by doing this? (1 mark) (b) The researcher decides to perform an LM test for fifth-order ARCH effects. Write down the null and alternative hypothesis for this test, a description of any regression you would run, an explanation of how you would construct the test statistic, a statement on the distribution of the test statistic under the null hypothesis, the 5% critical value for the test statistic, and what you would conclude if the null is rejected. (6 marks) (c) ) The researcher decided to estimate the MA(1)-GARCH(1,1) model of returns given by 7; = C +1, +Que o = do +azua+ Bond and obtained the following results: Coefficient Std. Error z-Statistic Prob. 0.058 0.045 1.28 0.205 0.453 0.115 3.94 0.005 Variance Equation co 0.323 0.047 6.87 0.001 0.120 0.010 10.67 0.002 B 0.830 0.014 58.38 0.000 26 What is the value of the unconditional variance in this model? (1 mark). In this model will a large shock to returns lead to forecasts of the conditional variance to be high and to remain high for many periods into the future? Justify your answer (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts