Question: QUESTION 1 - 10 marks Miller Inc. has requested a new line of credit to address the seasonality of revenues. The request is for an

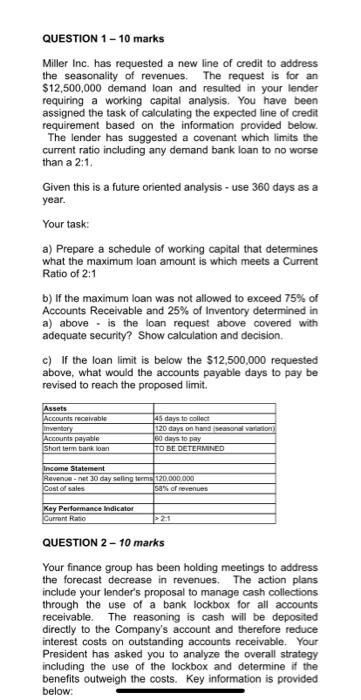

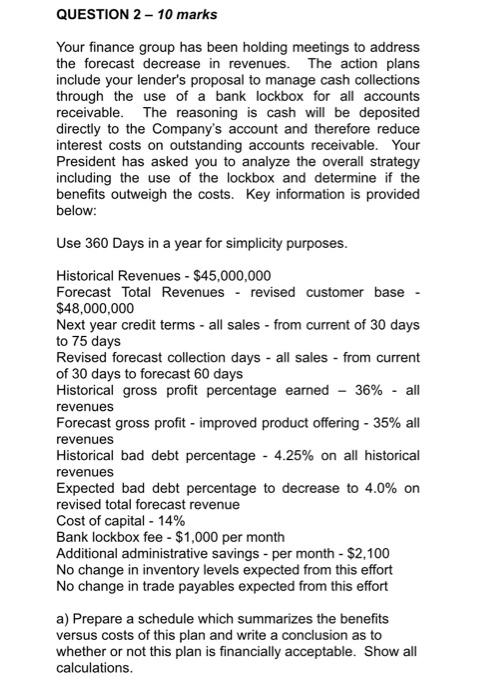

QUESTION 1 - 10 marks Miller Inc. has requested a new line of credit to address the seasonality of revenues. The request is for an $12,500,000 demand loan and resulted in your tender requiring a working capital analysis. You have been assigned the task of calculating the expected line of credit requirement based on the information provided below. The lender has suggested a covenant which limits the current ratio including any demand bank loan to no worse than a 2:1 Given this is a future oriented analysis - use 360 days as a year. Your task: a) Prepare a schedule of working capital that determines what the maximum loan amount is which meets a Current Ratio of 2:1 b) If the maximum loan was not allowed to exceed 75% of Accounts Receivable and 25% of Inventory determined in a) above is the loan request above covered with adequate security? Show calculation and decision. c) If the loan limit is below the $12,500,000 requested above, what would the accounts payable days to pay be revised to reach the proposed limit. Assets Accounts receivable inventory Accounts payable Short term bank loan 45 days to collect 120 days on hand seasonal and 60 days to pay TO BE DETERMINED Income Statement Revenge - net 30 day selling terms 120,000,000 Cost of sales sa's of revenues Key Performance Indicator Current Ratio 2.1 QUESTION 2 - 10 marks Your finance group has been holding meetings to address the forecast decrease in revenues. The action plans include your lender's proposal to manage cash collections through the use of a bank lockbox for all accounts receivable. The reasoning is cash will be deposited directly to the Company's account and therefore reduce interest costs on outstanding accounts receivable. Your President has asked you to analyze the overall strategy including the use of the lockbox and determine if the benefits outweigh the costs. Key information is provided below QUESTION 2 - 10 marks Your finance group has been holding meetings to address the forecast decrease in revenues. The action plans include your lender's proposal to manage cash collections through the use of a bank lockbox for all accounts receivable. The reasoning is cash will be deposited directly to the Company's account and therefore reduce interest costs on outstanding accounts receivable. Your President has asked you to analyze the overall strategy including the use of the lockbox and determine if the benefits outweigh the costs. Key information is provided below: Use 360 Days in a year for simplicity purposes. Historical Revenues - $45,000,000 Forecast Total Revenues - revised customer base - $48,000,000 Next year credit terms - all sales - from current of 30 days to 75 days Revised forecast collection days - all sales - from current of 30 days to forecast 60 days Historical gross profit percentage earned - 36% - all revenues Forecast gross profit - improved product offering -35% all revenues Historical bad debt percentage - 4.25% on all historical revenues Expected bad debt percentage to decrease to 4.0% on revised total forecast revenue Cost of capital - 14% Bank lockbox fee - $1,000 per month Additional administrative savings - per month - $2,100 No change in inventory levels expected from this effort No change in trade payables expected from this effort a) Prepare a schedule which summarizes the benefits versus costs of this plan and write a conclusion as to whether or not this plan is financially acceptable. Show all calculations. QUESTION 1 - 10 marks Miller Inc. has requested a new line of credit to address the seasonality of revenues. The request is for an $12,500,000 demand loan and resulted in your tender requiring a working capital analysis. You have been assigned the task of calculating the expected line of credit requirement based on the information provided below. The lender has suggested a covenant which limits the current ratio including any demand bank loan to no worse than a 2:1 Given this is a future oriented analysis - use 360 days as a year. Your task: a) Prepare a schedule of working capital that determines what the maximum loan amount is which meets a Current Ratio of 2:1 b) If the maximum loan was not allowed to exceed 75% of Accounts Receivable and 25% of Inventory determined in a) above is the loan request above covered with adequate security? Show calculation and decision. c) If the loan limit is below the $12,500,000 requested above, what would the accounts payable days to pay be revised to reach the proposed limit. Assets Accounts receivable inventory Accounts payable Short term bank loan 45 days to collect 120 days on hand seasonal and 60 days to pay TO BE DETERMINED Income Statement Revenge - net 30 day selling terms 120,000,000 Cost of sales sa's of revenues Key Performance Indicator Current Ratio 2.1 QUESTION 2 - 10 marks Your finance group has been holding meetings to address the forecast decrease in revenues. The action plans include your lender's proposal to manage cash collections through the use of a bank lockbox for all accounts receivable. The reasoning is cash will be deposited directly to the Company's account and therefore reduce interest costs on outstanding accounts receivable. Your President has asked you to analyze the overall strategy including the use of the lockbox and determine if the benefits outweigh the costs. Key information is provided below QUESTION 2 - 10 marks Your finance group has been holding meetings to address the forecast decrease in revenues. The action plans include your lender's proposal to manage cash collections through the use of a bank lockbox for all accounts receivable. The reasoning is cash will be deposited directly to the Company's account and therefore reduce interest costs on outstanding accounts receivable. Your President has asked you to analyze the overall strategy including the use of the lockbox and determine if the benefits outweigh the costs. Key information is provided below: Use 360 Days in a year for simplicity purposes. Historical Revenues - $45,000,000 Forecast Total Revenues - revised customer base - $48,000,000 Next year credit terms - all sales - from current of 30 days to 75 days Revised forecast collection days - all sales - from current of 30 days to forecast 60 days Historical gross profit percentage earned - 36% - all revenues Forecast gross profit - improved product offering -35% all revenues Historical bad debt percentage - 4.25% on all historical revenues Expected bad debt percentage to decrease to 4.0% on revised total forecast revenue Cost of capital - 14% Bank lockbox fee - $1,000 per month Additional administrative savings - per month - $2,100 No change in inventory levels expected from this effort No change in trade payables expected from this effort a) Prepare a schedule which summarizes the benefits versus costs of this plan and write a conclusion as to whether or not this plan is financially acceptable. Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts