Question: Question #1 - (10 marks) Using the following projections and the template in Appendix A build a Pro-forma Income Statement for the expansion. The first

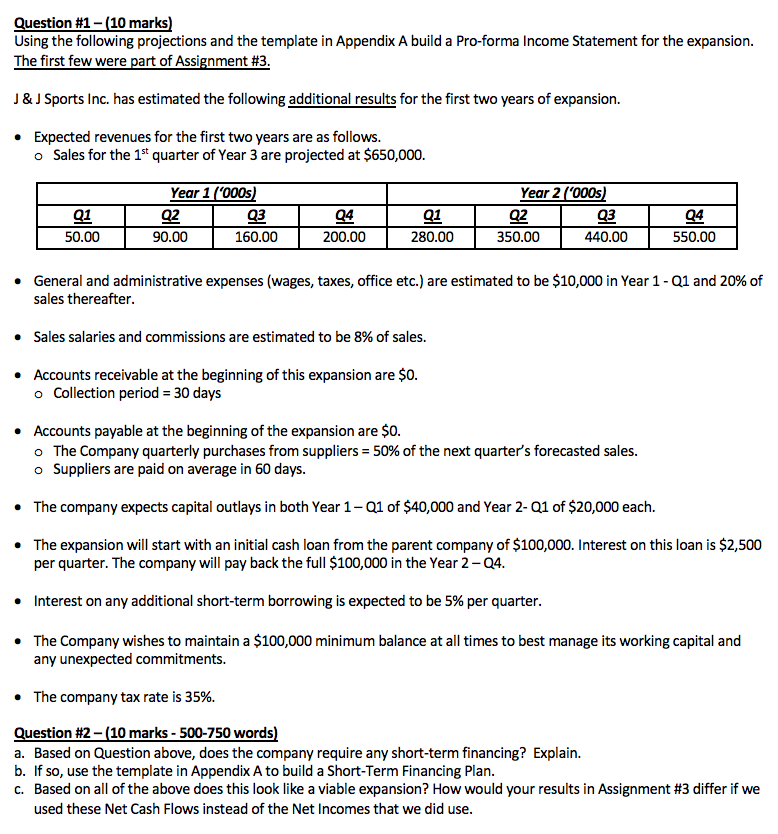

Question #1 - (10 marks) Using the following projections and the template in Appendix A build a Pro-forma Income Statement for the expansion. The first few were part of Assignment #3. J & J Sports Inc. has estimated the following additional results for the first two years of expansion. Expected revenues for the first two years are as follows. o Sales for the 1st quarter of Year 3 are projected at $650,000. Year 1 ('000s) Q2 Q3 90.00 160.00 Q1 50.00 Q4 Q1 280.00 Year 2000s) Q2 Q3 350.00 440.00 Q4 550.00 200.00 General and administrative expenses (wages, taxes, office etc.) are estimated to be $10,000 in Year 1 - Q1 and 20% of sales thereafter. Sales salaries and commissions are estimated to be 8% of sales. Accounts receivable at the beginning of this expansion are $0. o Collection period = 30 days Accounts payable at the beginning of the expansion are $0. o The Company quarterly purchases from suppliers = 50% of the next quarter's forecasted sales. o Suppliers are paid on average in 60 days. The company expects capital outlays in both Year 1-Q1 of $40,000 and Year 2-Q1 of $20,000 each. The expansion will start with an initial cash loan from the parent company of $100,000. Interest on this loan is $2,500 per quarter. The company will pay back the full $100,000 in the Year 2-Q4. Interest on any additional short-term borrowing is expected to be 5% per quarter. The Company wishes to maintain a $100,000 minimum balance at all times to best manage its working capital and any unexpected commitments. The company tax rate is 35%. Question #2 - (10 marks - 500-750 words) a. Based on Question above, does the company require any short-term financing? Explain. b. If so, use the template in Appendix A to build a Short-Term Financing Plan. C. Based on all of the above does this look like a viable expansion? How would your results in Assignment #3 differ if we used these Net Cash Flows instead of the Net Incomes that we did use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts