Question: Question 1: (10 Points) A1, B1, C1, C2, D3 Rami, an accountant at Atrium Co., has compiled the following information from the company records as

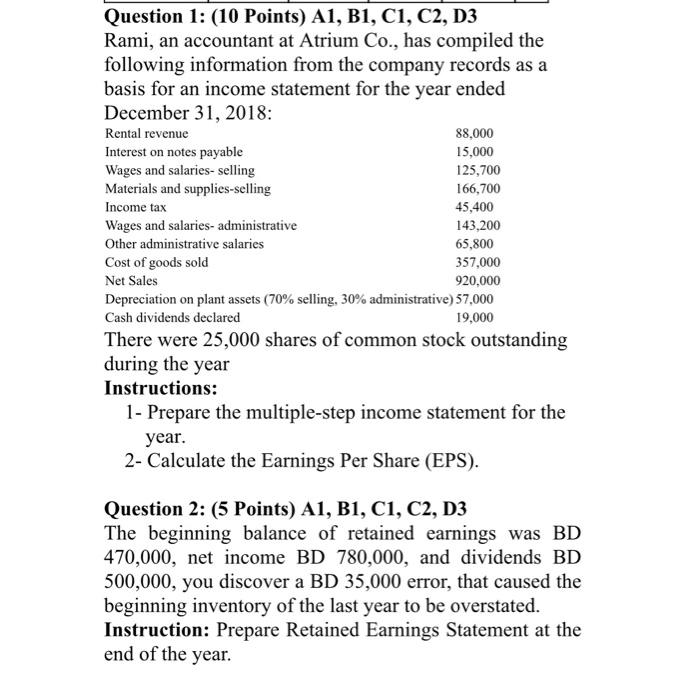

Question 1: (10 Points) A1, B1, C1, C2, D3 Rami, an accountant at Atrium Co., has compiled the following information from the company records as a basis for an income statement for the year ended December 31, 2018: Rental revenue 88,000 Interest on notes payable 15,000 Wages and salaries-selling 125,700 Materials and supplies-selling 166,700 Income tax 45,400 Wages and salaries-administrative 143,200 Other administrative salaries 65,800 Cost of goods sold 357,000 Net Sales 920,000 Depreciation on plant assets (70% selling, 30% administrative) 57,000 Cash dividends declared 19,000 There were 25,000 shares of common stock outstanding during the year Instructions: 1- Prepare the multiple-step income statement for the year. 2- Calculate the Earnings Per Share (EPS). Question 2: (5 Points) A1, B1, C1, C2, D3 The beginning balance of retained earnings was BD 470,000, net income BD 780,000, and dividends BD 500,000, you discover a BD 35,000 error, that caused the beginning inventory of the last year to be overstated. Instruction: Prepare Retained Earnings Statement at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts