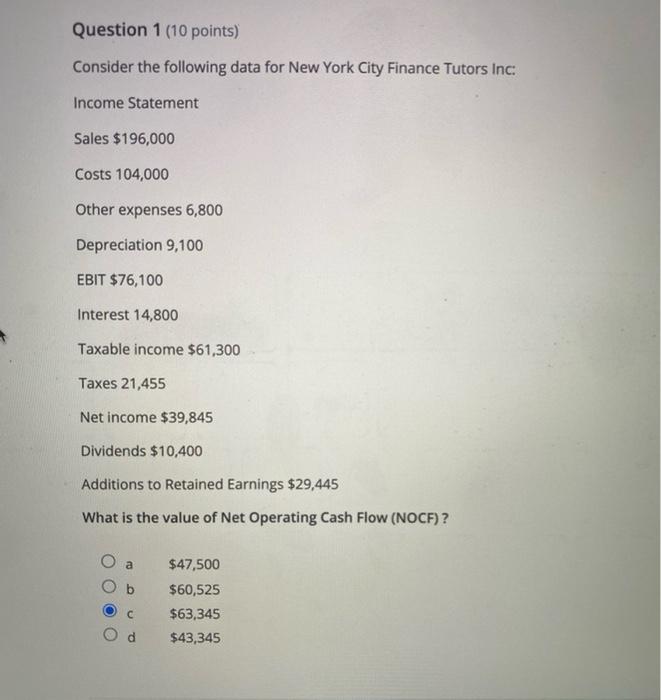

Question: Question 1 (10 points) Consider the following data for New York City Finance Tutors Inc. Income Statement Sales $196,000 Costs 104,000 Other expenses 6,800 Depreciation

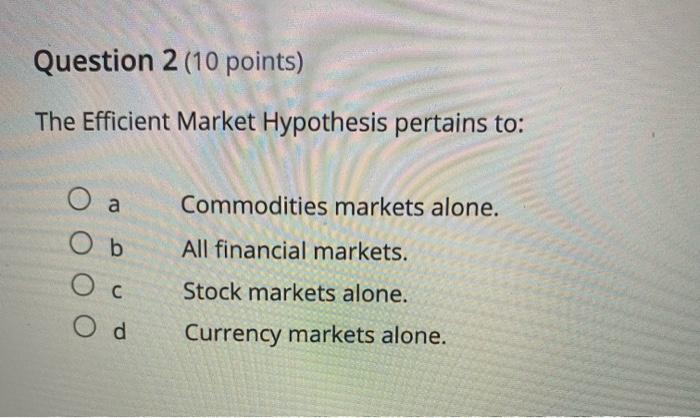

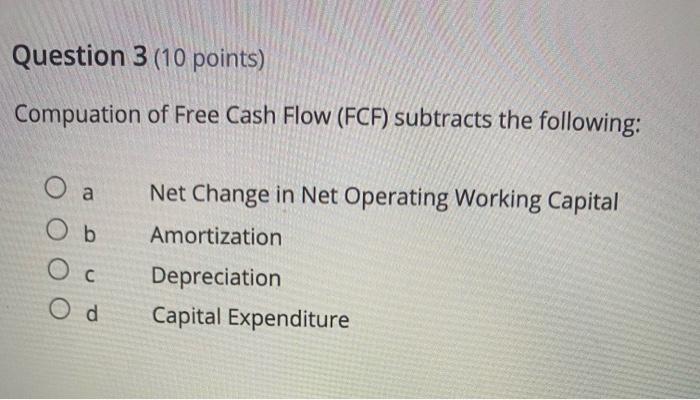

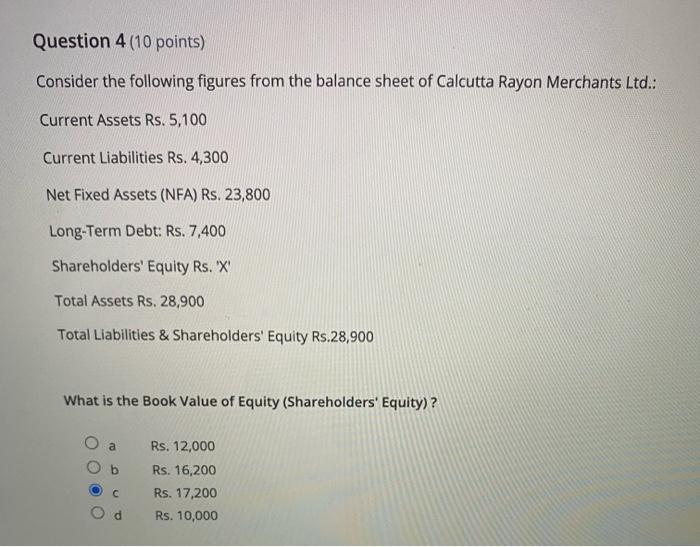

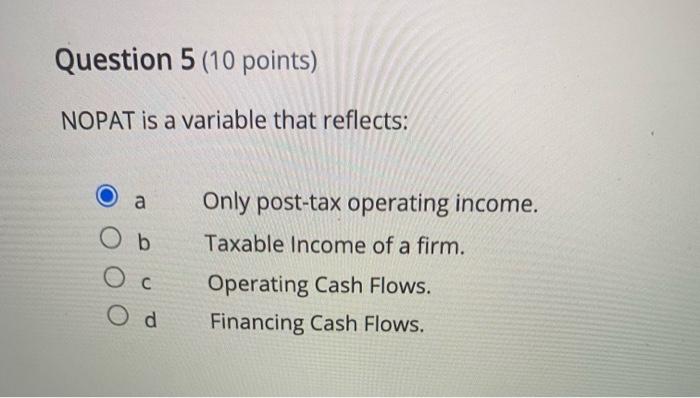

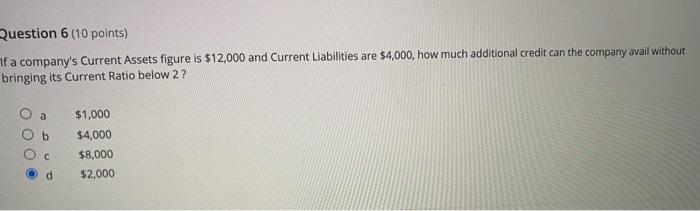

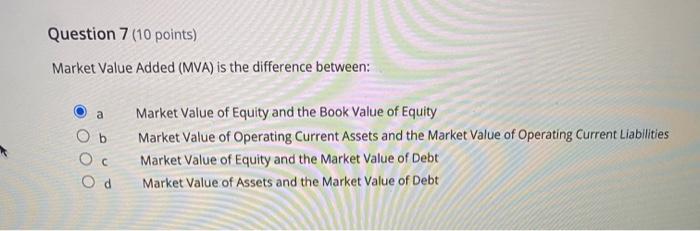

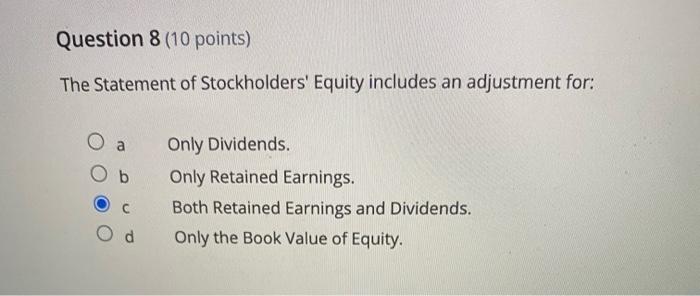

Question 1 (10 points) Consider the following data for New York City Finance Tutors Inc. Income Statement Sales $196,000 Costs 104,000 Other expenses 6,800 Depreciation 9,100 EBIT $76,100 Interest 14,800 Taxable income $61,300 Taxes 21,455 Net income $39,845 Dividends $10,400 Additions to Retained Earnings $29,445 What is the value of Net Operating Cash Flow (NOCF)? a $47,500 $60,525 $63,345 $43,345 Question 2 (10 points) The Efficient Market Hypothesis pertains to: Commodities markets alone. All financial markets. Ob Stock markets alone. Od Currency markets alone. Question 3 (10 points) Compuation of Free Cash Flow (FCF) subtracts the following: O a Ob Net Change in Net Operating Working Capital Amortization Depreciation Capital Expenditure Od Question 4 (10 points) Consider the following figures from the balance sheet of Calcutta Rayon Merchants Ltd.: Current Assets Rs. 5,100 Current Liabilities Rs. 4,300 Net Fixed Assets (NFA) Rs. 23,800 Long-Term Debt: Rs. 7,400 Shareholders' Equity Rs. 'X' Total Assets Rs. 28,900 Total Liabilities & Shareholders' Equity Rs.28,900 What is the Book Value of Equity (Shareholders' Equity)? a b Rs. 12,000 Rs. 16,200 Rs. 17,200 Rs. 10,000 d Question 5 (10 points) NOPAT is a variable that reflects: a Only post-tax operating income. Ob Taxable income of a firm. O d Operating Cash Flows. Financing Cash Flows. Question 6 (10 points) If a company's Current Assets figure is $12,000 and Current Liabilities are $4,000, how much additional credit can the company avail without bringing its Current Ratio below 2? O a b $1,000 $4,000 $8,000 $2,000 C d Question 7 (10 points) Market Value Added (MVA) is the difference between: a b Market value of Equity and the Book Value of Equity Market Value of Operating Current Assets and the Market Value of Operating Current Liabilities Market Value of Equity and the Market Value of Debt Market Value of Assets and the Market Value of Debt Od Question 8 (10 points) The Statement of Stockholders' Equity includes an adjustment for: Only Dividends. Only Retained Earnings. Both Retained Earnings and Dividends. Only the Book Value of Equity.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts