Question: Question 1 (10 points) In calculating NOWC, we subtract interest -bearing liabilities because: O a They are not really liabilities . Ob They are relatively

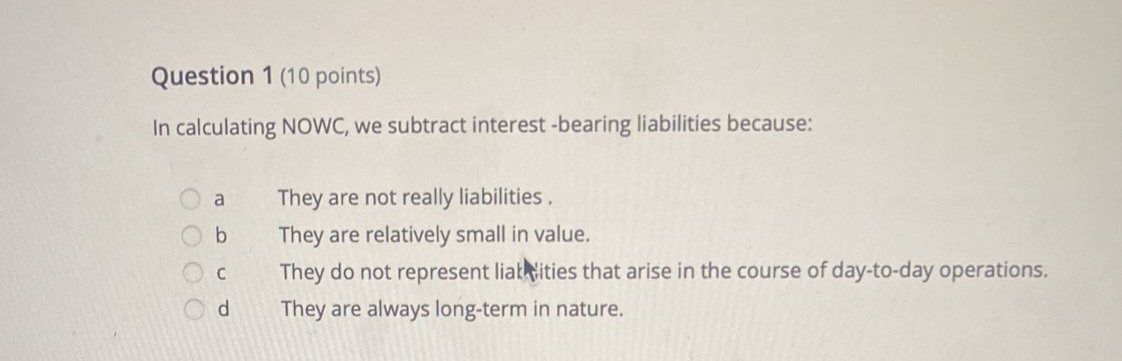

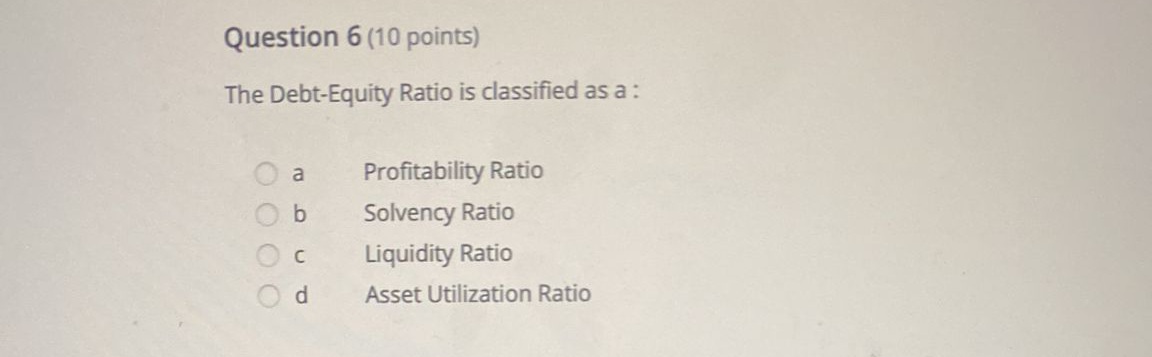

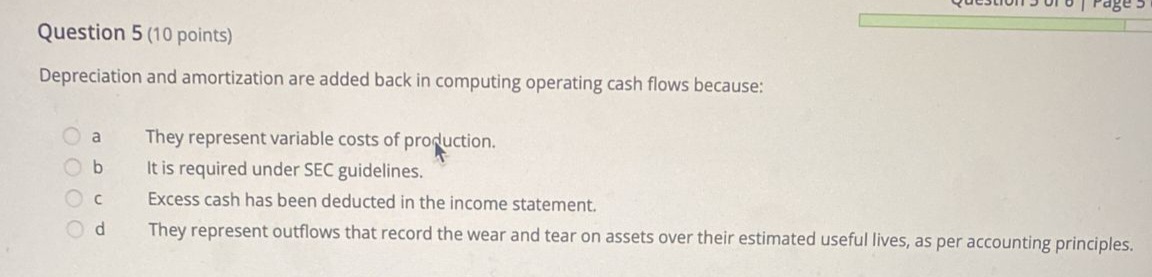

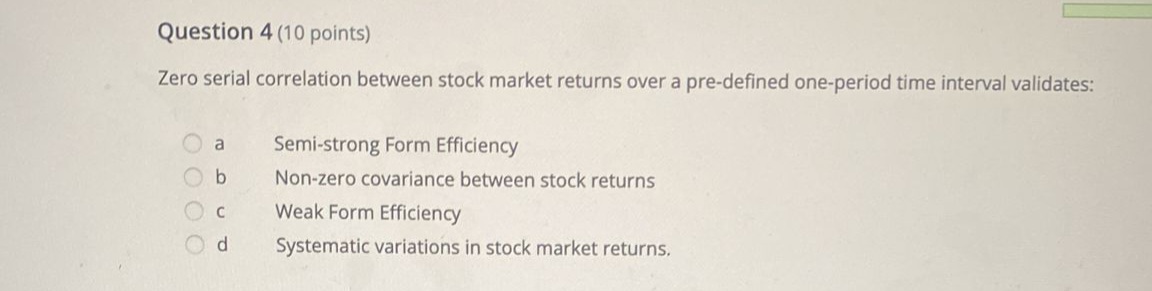

Question 1 (10 points) In calculating NOWC, we subtract interest -bearing liabilities because: O a They are not really liabilities . Ob They are relatively small in value. O C They do not represent liatities that arise in the course of day-to-day operations. O They are always long-term in nature.Question 6 (10 points) The Debt-Equity Ratio is classified as a : O a Profitability Ratio Ob Solvency Ratio O c Liquidity Ratio O d Asset Utilization Ratioes Question 5 (10 points) Depreciation and amortization are added back in computing operating cash flows because: Oa They represent variable costs of production. Ob It is required under SEC guidelines. OC Excess cash has been deducted in the income statement. O d They represent outflows that record the wear and tear on assets over their estimated useful lives, as per accounting principles.Question 4 (10 points) Zero serial correlation between stock market returns over a pre-defined one-period time interval validates: O Semi-strong Form Efficiency Ob Non-zero covariance between stock returns OC Weak Form Efficiency Od Systematic variations in stock market returns.Question 3 (10 points) The Future Value of an ordinary annuity is the sum of : O a An arithmetic progresion. Ob Only an infinite geometric progression. O C A harmonic progression. O d A geometric progression.Question 2 (10 points) In calculating the Internal Rate of Return (IRR), the assumption is that: Oa Net Present Value is always positive. Ob Net Present Value is indeterminate. OC Net Present Value is always zero. Od Net Present Value is always negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts