Question: Question 1 (10 points) Please use our Chapter 8 PPT slides to answer the question: Suppose a portfolio manager wishes to construct a portfolio using

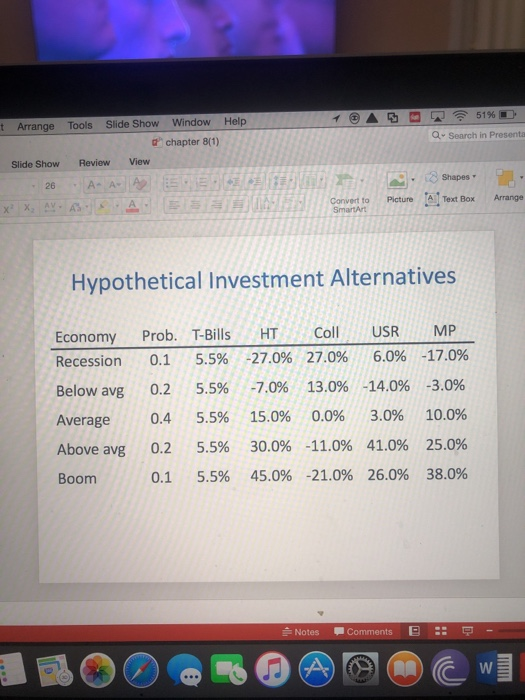

Question 1 (10 points) Please use our Chapter 8 PPT slides to answer the question: Suppose a portfolio manager wishes to construct a portfolio using two securities Call and USR, both of their return data are shown in the Slide 5 with the title "Hypothetical Investment Alternatives". Specifically, the manger allocates $60,000 in the Coll and $30,000 in the USR. Please calculate (1) Portfolio Expected Return (2) Portfolio Standard Deviation Arrange Tools Slide Show TAGE Window Help chapter 8(1) 51%D Search in Present Slide Show 26 Review View An A- A E Shapes Text Box Convert to Picture Arrange Hypothetical Investment Alternatives Economy Recession Below avg Average Above avg Boom Prob. T-Bills 0.1 5.5% 0.2 5.5% 0.4 5.5% 0.2 5.5% 0.1 5.5% HT -27.0% -7.0% 15.0% 30.0% 45.0% Coll USR MP 27.0% 6.0% -17.0% 13.0% -14.0% -3.0% 0.0% 3.0% 10.0% -11.0% 41.0% 25.0% -21.0% 26.0% 38.0% Notes Comments B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts