Question: Question 1 (10 points) Problem IV (10 marks) LA2 W2021 a Niro Corporation is finalizing their December 31, 2020 financial statements. Management has discovered that

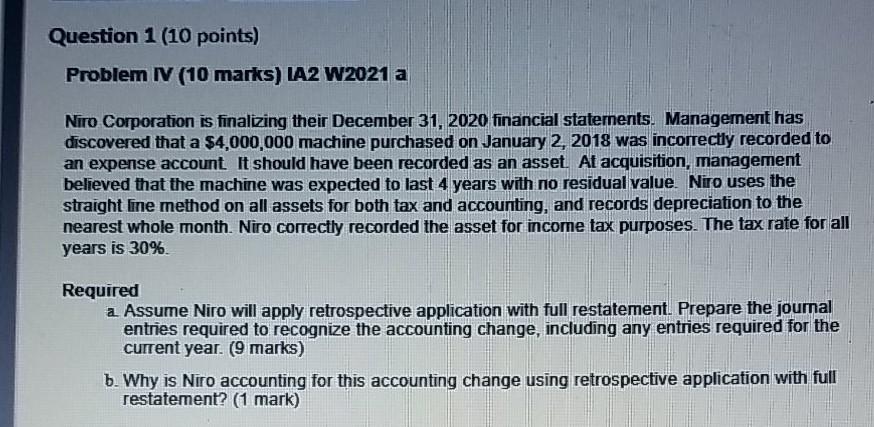

Question 1 (10 points) Problem IV (10 marks) LA2 W2021 a Niro Corporation is finalizing their December 31, 2020 financial statements. Management has discovered that a $4,000,000 machine purchased on January 2, 2018 was incorrectly recorded to an expense account It should have been recorded as an asset. At acquisition, management believed that the machine was expected to last 4 years with no residual value Niro uses the straight line method on all assets for both tax and accounting, and records depreciation to the nearest whole month. Niro correctly recorded the asset for income tax purposes. The tax rate for all years is 30% Required a Assume Niro will apply retrospective application with full restatement. Prepare the journal entries required to recognize the accounting change, including any entries required for the current year. (9 marks) b. Why is Niro accounting for this accounting change using retrospective application with full restatement? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts