Question: Question 1 10 points Save Answer Max. Marks = 10 = 2 + 4+4 Suppose that International Mudarabah Fund (IMF) accepts investments in various currencies

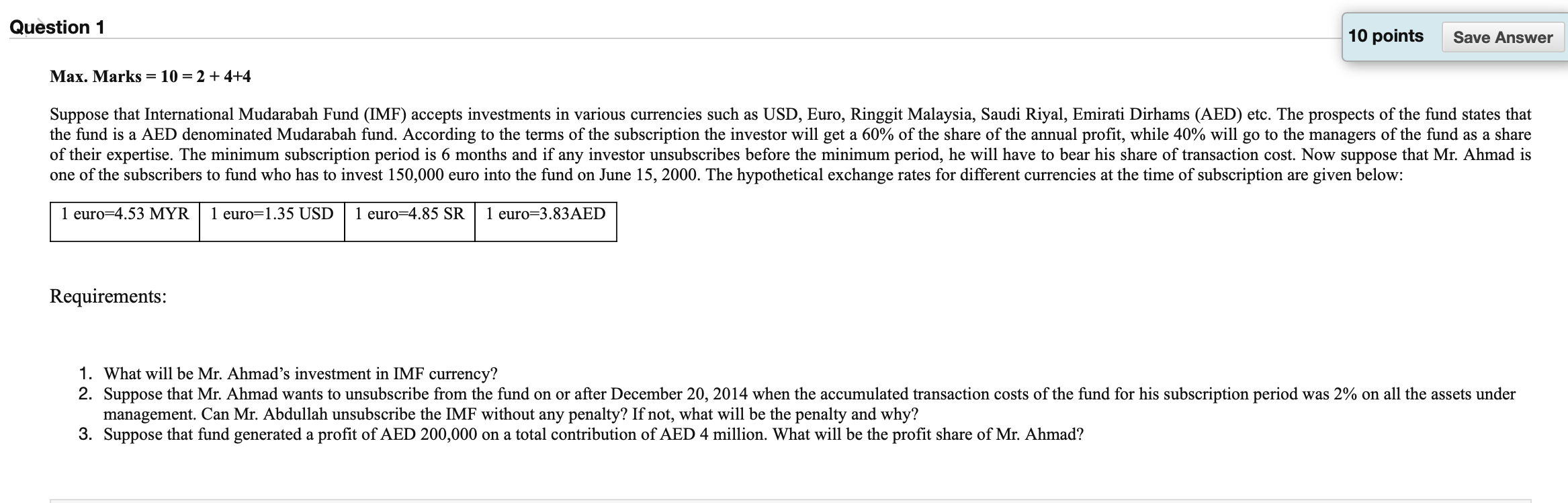

Question 1 10 points Save Answer Max. Marks = 10 = 2 + 4+4 Suppose that International Mudarabah Fund (IMF) accepts investments in various currencies such as USD, Euro, Ringgit Malaysia, Saudi Riyal, Emirati Dirhams (AED) etc. The prospects of the fund states that the fund is a AED denominated Mudarabah fund. According to the terms of the subscription the investor will get a 60% of the share of the annual profit, while 40% will go to the managers of the fund as a share of their expertise. The minimum subscription period is 6 months and if any investor unsubscribes before the minimum period, he will have to bear his share of transaction cost. Now suppose that Mr. Ahmad is one of the subscribers to fund who has to invest 150,000 euro into the fund on June 15, 2000. The hypothetical exchange rates for different currencies at the time of subscription are given below: 1 euro=4.53 MYR 1 euro=1.35 USD 1 euro=4.85 SR 1 euro=3.83AED Requirements: 1. What will be Mr. Ahmad's investment in IMF currency? 2. Suppose that Mr. Ahmad wants to unsubscribe from the fund on or after December 20, 2014 when the accumulated transaction costs of the fund for his subscription period was 2% on all the assets under management. Can Mr. Abdullah unsubscribe the IMF without any penalty? If not, what will be the penalty and why? 3. Suppose that fund generated a profit of AED 200,000 on a total contribution of AED 4 million. What will be the profit share of Mr. Ahmad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts