Question: Question 1 10 points Save Answer Your uncle has $2.000 invested in a mutual fund with a beta of 1.2 and a standard deviation of

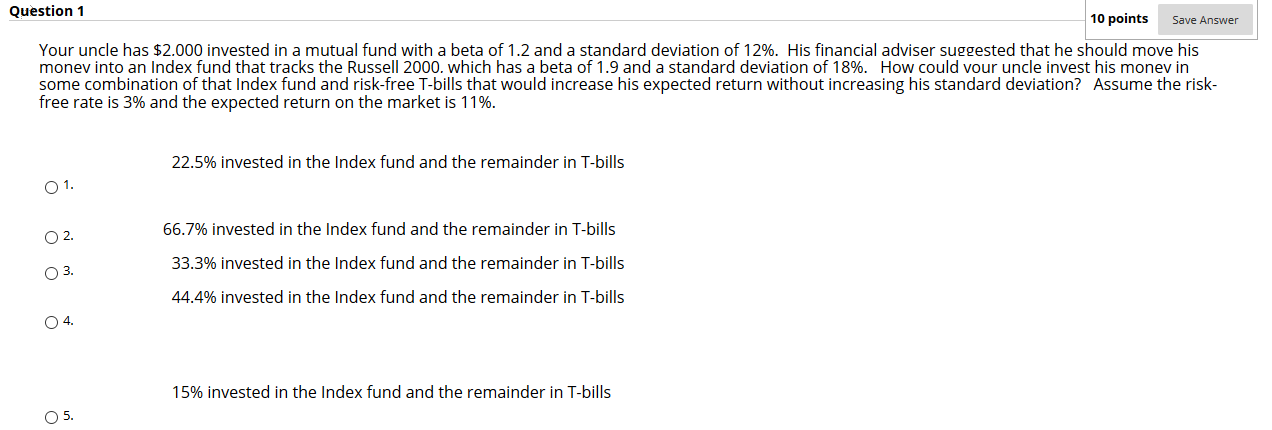

Question 1 10 points Save Answer Your uncle has $2.000 invested in a mutual fund with a beta of 1.2 and a standard deviation of 12%. His financial adviser suggested that he should move his money into an Index fund that tracks the Russell 2000. which has a beta of 1.9 and a standard deviation of 18%. How could vour uncle invest his monev in some combination of that Index fund and risk-free T-bills that would increase his expected return without increasing his standard deviation? Assume the risk- free rate is 3% and the expected return on the market is 11%. 22.5% invested in the Index fund and the remainder in T-bills 66.7% invested in the Index fund and the remainder in T-bills 33.3% invested in the Index fund and the remainder in T-bills 44.4% invested in the Index fund and the remainder in T-bills 15% invested in the Index fund and the remainder in T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts