Question: Question 1 (10 points) You wish to make a substantial down payment on a lake cottage and you currently have $15,725 invested at an annual

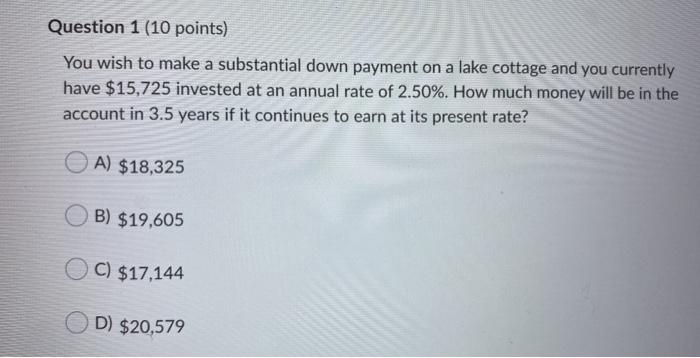

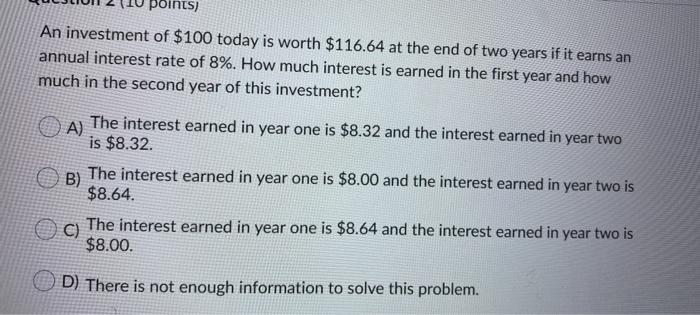

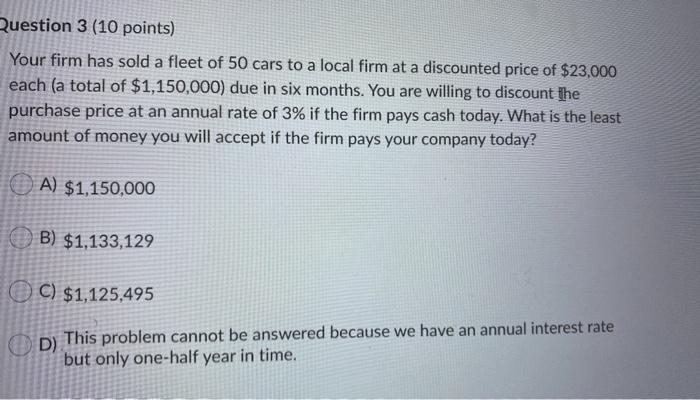

Question 1 (10 points) You wish to make a substantial down payment on a lake cottage and you currently have $15,725 invested at an annual rate of 2.50%. How much money will be in the account in 3.5 years if it continues to earn at its present rate? OA) $18,325 B) $19,605 C) $17,144 D) $20,579 oints) An investment of $100 today is worth $116.64 at the end of two years if it earns an annual interest rate of 8%. How much interest is earned in the first year and how much in the second year of this investment? A) The interest earned in year one is $8.32 and the interest earned in year two is $8.32 B) The interest earned in year one is $8.00 and the interest earned in year two is $8.64. C) The interest earned in year one is $8.64 and the interest earned in year two is $8.00. D) There is not enough information to solve this problem. Question 3 (10 points) Your firm has sold a fleet of 50 cars to a local firm at a discounted price of $23,000 each (a total of $1,150,000) due in six months. You are willing to discount the purchase price at an annual rate of 3% if the firm pays cash today. What is the least amount of money you will accept if the firm pays your company today? A) $1,150,000 B) $1,133,129 OC) $1,125,495 OD) This problem cannot be answered because we have an annual interest rate but only one-half year in time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts