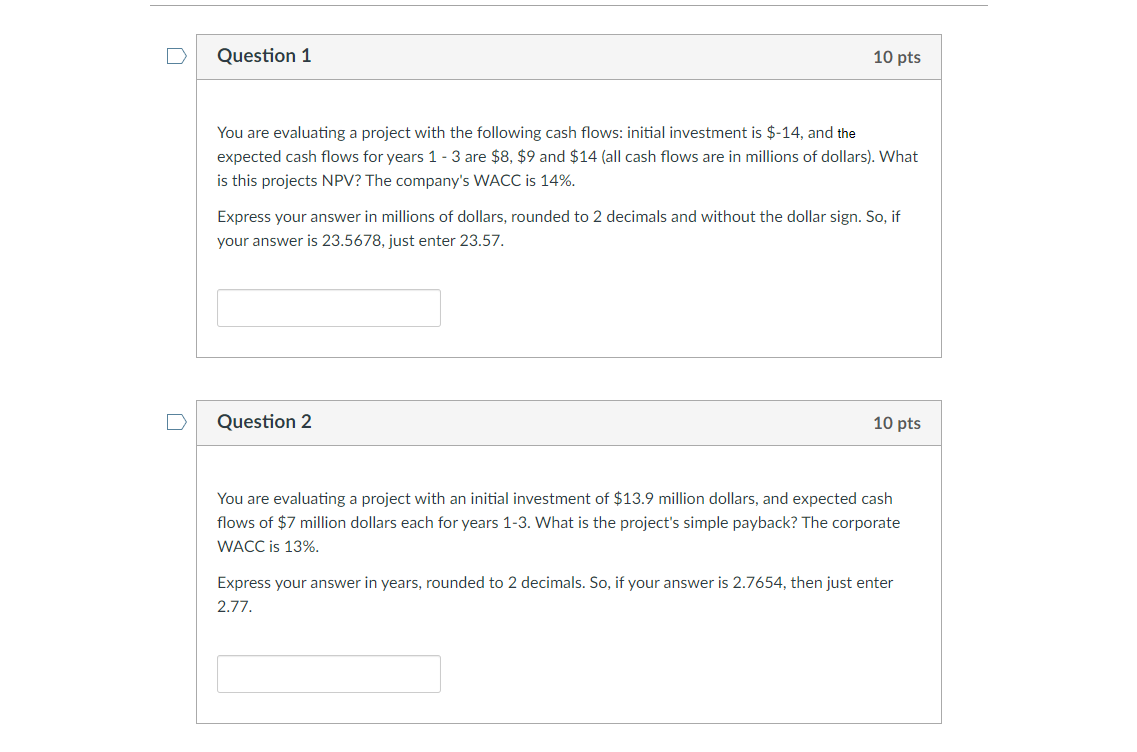

Question: Question 1 10 pts You are evaluating a project with the following cash flows: initial investment is $-14, and the expected cash flows for years

Question 1 10 pts You are evaluating a project with the following cash flows: initial investment is $-14, and the expected cash flows for years 1 - 3 are $8, $9 and $14 (all cash flows are in millions of dollars). What is this projects NPV? The company's WACC is 14%. Express your answer in millions of dollars, rounded to 2 decimals and without the dollar sign. So, if your answer is 23.5678, just enter 23.57. n Question 2 10 pts You are evaluating a project with an initial investment of $13.9 million dollars, and expected cash flows of $7 million dollars each for years 1-3. What is the project's simple payback? The corporate WACC is 13%. Express your answer in years, rounded to 2 decimals. So, if your answer is 2.7654, then just enter 2.77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts