Question: QUESTION 1 1.1 REQUIRED Use the information given below to calculate the following for the year 2022: 1.1.1 The number of units that should be

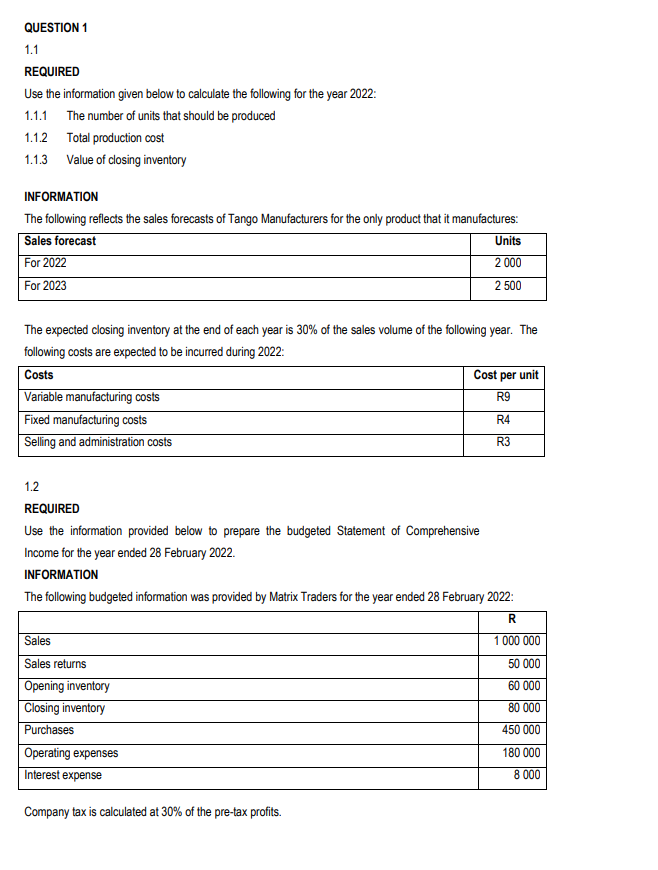

QUESTION 1 1.1 REQUIRED Use the information given below to calculate the following for the year 2022: 1.1.1 The number of units that should be produced 1.1.2 Total production cost 1.1.3 Value of closing inventory INFORMATION The following reflects the sales forecasts of Tango Manufacturers for the only product that it manufactures: Sales forecast Units For 2022 2 000 For 2023 2 500 The expected closing inventory at the end of each year is 30% of the sales volume of the following year. The following costs are expected to be incurred during 2022: Costs Cost per unit Variable manufacturing costs R9 Fixed manufacturing costs R4 Selling and administration costs R3 1.2 REQUIRED Use the information provided below to prepare the budgeted Statement of Comprehensive Income for the year ended 28 February 2022. INFORMATION The following budgeted information was provided by Matrix Traders for the year ended 28 February 2022: R Sales Sales returns 1 000 000 50 000 60 000 80 000 Opening inventory Closing inventory Purchases Operating expenses Interest expense 450 000 180 000 8 000 Company tax is calculated at 30% of the pre-tax profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts