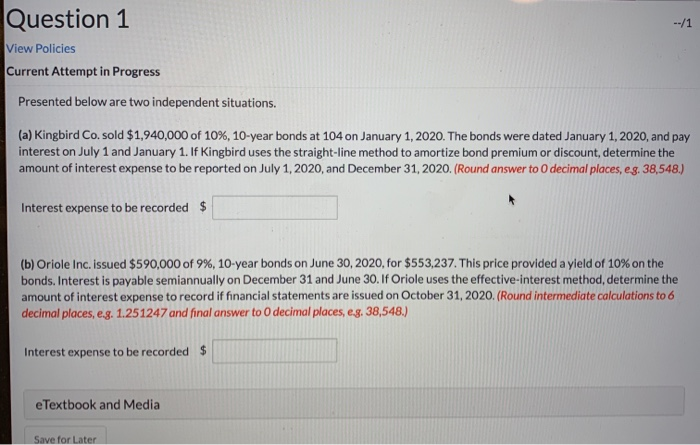

Question: Question 1 --11 View Policies Current Attempt in Progress Presented below are two independent situations. (a) Kingbird Co. sold $1,940,000 of 10%, 10-year bonds at

Question 1 --11 View Policies Current Attempt in Progress Presented below are two independent situations. (a) Kingbird Co. sold $1,940,000 of 10%, 10-year bonds at 104 on January 1, 2020. The bonds were dated January 1, 2020, and pay interest on July 1 and January 1. If Kingbird uses the straight-line method to amortize bond premium or discount, determine the amount of interest expense to be reported on July 1, 2020, and December 31, 2020. (Round answer to decimal places, eg. 38,548.) Interest expense to be recorded $ (b) Oriole Inc. issued $590,000 of 9%, 10-year bonds on June 30, 2020, for $553,237. This price provided a yield of 10% on the bonds. Interest is payable semiannually on December 31 and June 30. If Oriole uses the effective interest method, determine the amount of interest expense to recordif financial statements are issued on October 31, 2020. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.) Interest expense to be recorded $ eTextbook and Media Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts