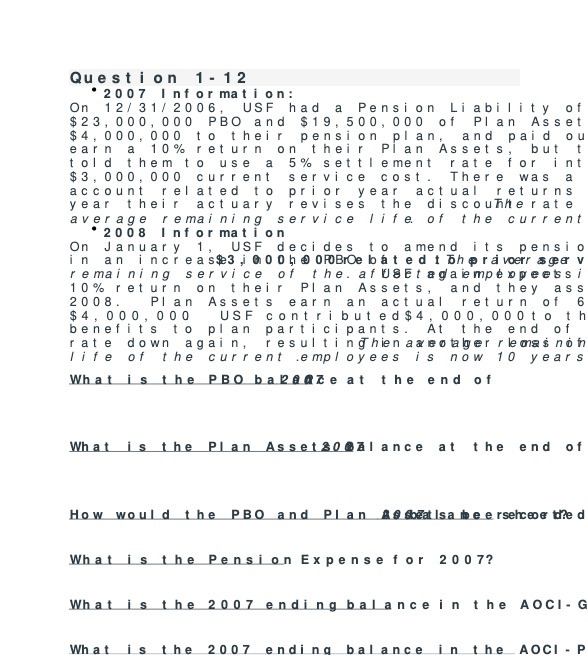

Question: Question 1- 12 * 2007 Information: On 12/ 31/ 2006, USF had a Pension Liability of $23, 000, 000 PBO and $19, 500, 000 of

Question 1- 12 * 2007 Information: On 12/ 31/ 2006, USF had a Pension Liability of $23, 000, 000 PBO and $19, 500, 000 of Plan Asset $4, 000, 000 to their pension plan, and paid ou earn a 10% return on their Plan Assets but t told them to use a 5% settlement rate for int $3 , 000 , 000 current service cost. There was a account related to prior year actual returns year their actuary revises the discouhhe rate average remaining service life of the current 2008 Information On January USF decides to amend its pensio in an increase3 , G0 0 he OfOB Ce bat ed t bher a verr sgea v remaining service of the. af DBEt agaempeppeets i 10% return on their Plan Assets, and they ass 2008. Plan Assets earn an actual return of 6 $4 , 0 00, 000 USF contributed$4 , 000 , 00 0 to th benefits to plan participants. At the end of rate down again, result ing hien axeobaber rlemas not life of the current employees is now 10 years What is the PBO babeade at the end of What is the Plan Asset 30@Al ance at the end of How would the PBO and Plan Ag balsa beerselcee the d What is the Pension Expense for 2007? What is the 2007 ending balance in the AOCI - G What he 2007 ending bal ance he AOCI - P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts