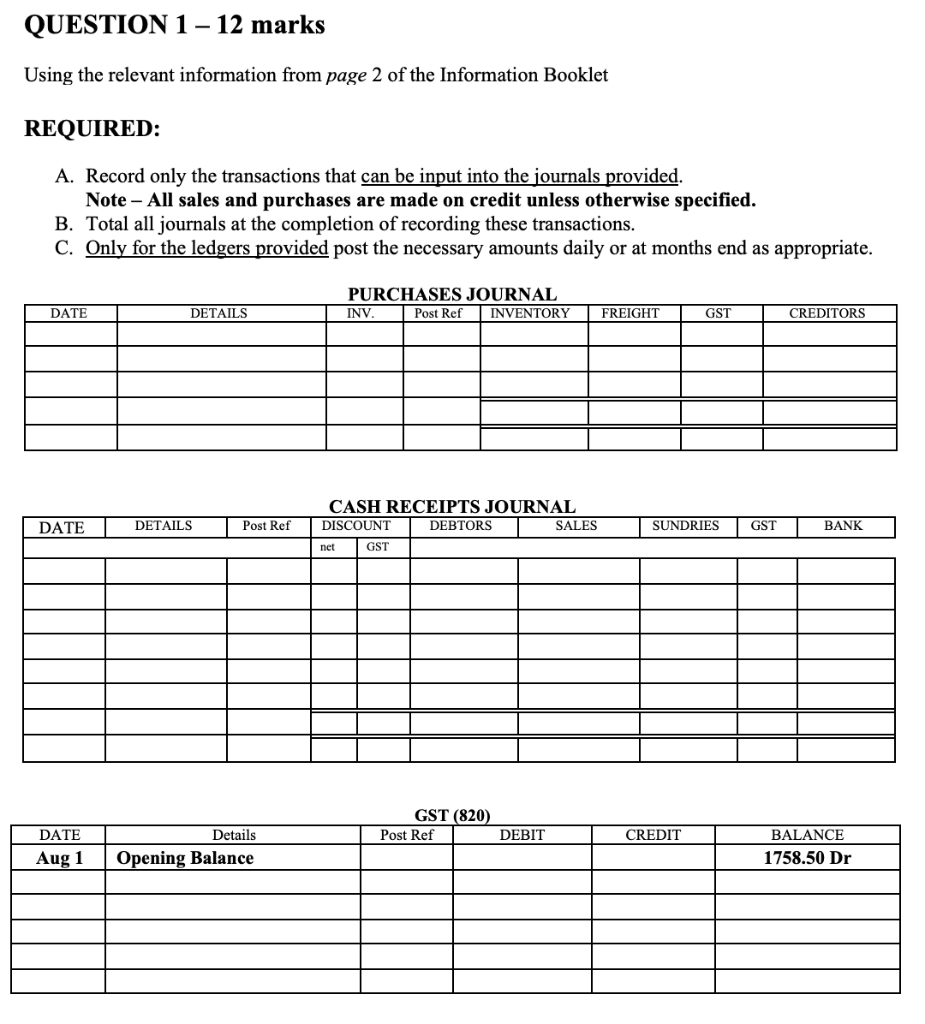

Question: QUESTION 1 - 12 marks Using the relevant information from page 2 of the Information Booklet REQUIRED: A. Record only the transactions that can be

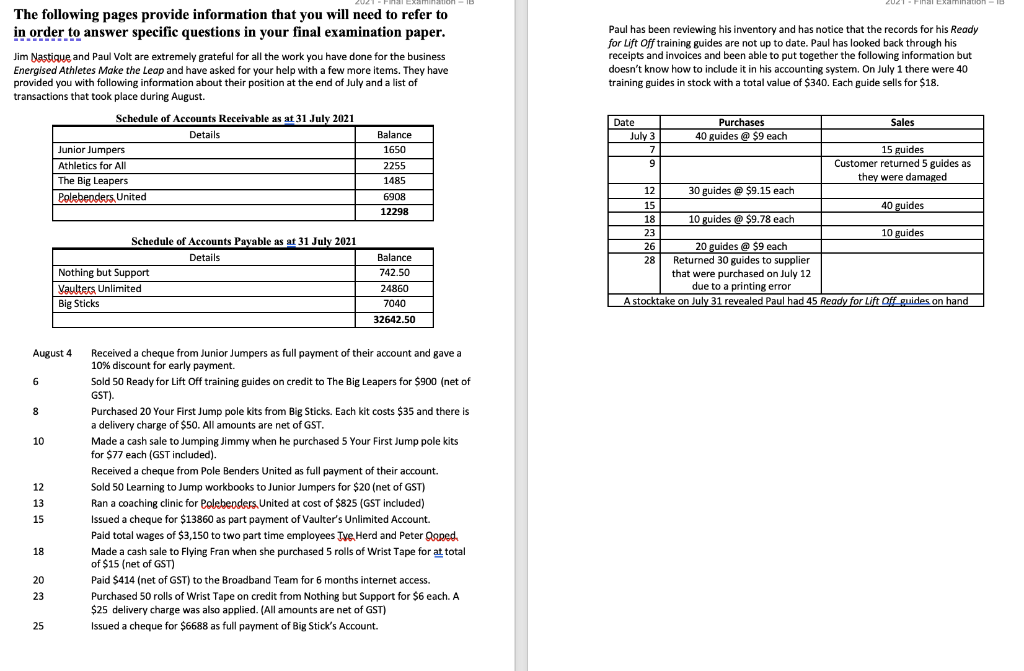

QUESTION 1 - 12 marks Using the relevant information from page 2 of the Information Booklet REQUIRED: A. Record only the transactions that can be input into the journals provided. Note - All sales and purchases are made on credit unless otherwise specified. B. Total all journals at the completion of recording these transactions. C. Only for the ledgers provided post the necessary amounts daily or at months end as appropriate. PURCHASES JOURNAL INV Post Ref INVENTORY DATE DETAILS FREIGHT GST CREDITORS CASH RECEIPTS JOURNAL DISCOUNT DEBTORS SALES DATE DETAILS Post Ref SUNDRIES GST BANK net GST GST (820) Post Ref DEBIT CREDIT DATE Aug 1 Details Opening Balance BALANCE 1758.50 Dr Paul has been reviewing his inventory and has notice that the records for his Ready for Lift Off training guides are not up to date. Paul has looked back through his receipts and invoices and been able to put together the following information but doesn't know how to include it in his accounting system. On July 1 there were 40 training guides in stock with a total value of $340. Each guide sells for $18. The following pages provide information that you will need to refer to in order to answer specific questions in your final examination paper. Jim Nastique and Paul Volt are extremely grateful for all the work you have done for the business Energised Athletes Make the Leap and have asked for your help with a few more items. They have provided you with following information about their position at the end of July and a list of transactions that took place during August. Schedule of Accounts Receivable as at 31 July 2021 Details Balance Junior Jumpers 1650 Athletics for All 2255 The Big Leapers 1485 Polebenders United 6908 12298 Date Purchases Sales July 3 40 guides @ $9 each 7 15 guides 9 9 Customer returned 5 guides as they were damaged 12 30 guides @ $9.15 each 15 40 guides 18 10 guides @ $9.78 each 23 10 guides 26 20 guides @ $9 each 28 Returned 30 guides to supplier that were purchased on July 12 due to a printing error a A stocktake on July 31 revealed Paul had 45 Ready for Lift Off guides on hand Schedule of Accounts Payable as at 31 July 2021 Details Nothing but Support Vaulters Unlimited Big Sticks Balance 742.50 24860 7040 32642.50 August 4 6 8 10 12 13 15 Received a cheque from Junior Jumpers as full payment of their account and gave a 10% discount for early payment. Sold 50 Ready for Lift Off training guides on credit to The Big Leapers for $900 (net of GST) Purchased 20 Your First Jump pole kits from Big Sticks. Each kit costs $35 and there is a delivery charge of $50. All amounts are net of GST. Made a cash sale to Jumping Jimmy when he purchased 5 Your First Jump pole kits for $77 each (GST included). Received a cheque from Pole Benders United as full payment of their account. Sold 50 Learning to Jump workbooks to Junior Jumpers for $20 (net of GST) Ran a coaching clinic for Polebenders. United at cost of $825 (GST included) Issued a cheque for $13860 as part payment of Vaulter's Unlimited Account. Paid total wages of $3,150 to two part time employees Tve. Herd and Peter Osped. Made a cash sale to Flying Fran when she purchased 5 rolls of Wrist Tape for at total of $15 (net of GST) Paid $414 (net of GST) to the Broadband Team for 6 months internet access. Purchased 50 rolls of Wrist Tape on credit from Nothing but Support for $6 each. A $25 delivery charge was also applied. (All amounts are net of GST) Issued a cheque for $6688 as full payment of Big Stick's Account. 18 20 23 25 QUESTION 1 - 12 marks Using the relevant information from page 2 of the Information Booklet REQUIRED: A. Record only the transactions that can be input into the journals provided. Note - All sales and purchases are made on credit unless otherwise specified. B. Total all journals at the completion of recording these transactions. C. Only for the ledgers provided post the necessary amounts daily or at months end as appropriate. PURCHASES JOURNAL INV Post Ref INVENTORY DATE DETAILS FREIGHT GST CREDITORS CASH RECEIPTS JOURNAL DISCOUNT DEBTORS SALES DATE DETAILS Post Ref SUNDRIES GST BANK net GST GST (820) Post Ref DEBIT CREDIT DATE Aug 1 Details Opening Balance BALANCE 1758.50 Dr Paul has been reviewing his inventory and has notice that the records for his Ready for Lift Off training guides are not up to date. Paul has looked back through his receipts and invoices and been able to put together the following information but doesn't know how to include it in his accounting system. On July 1 there were 40 training guides in stock with a total value of $340. Each guide sells for $18. The following pages provide information that you will need to refer to in order to answer specific questions in your final examination paper. Jim Nastique and Paul Volt are extremely grateful for all the work you have done for the business Energised Athletes Make the Leap and have asked for your help with a few more items. They have provided you with following information about their position at the end of July and a list of transactions that took place during August. Schedule of Accounts Receivable as at 31 July 2021 Details Balance Junior Jumpers 1650 Athletics for All 2255 The Big Leapers 1485 Polebenders United 6908 12298 Date Purchases Sales July 3 40 guides @ $9 each 7 15 guides 9 9 Customer returned 5 guides as they were damaged 12 30 guides @ $9.15 each 15 40 guides 18 10 guides @ $9.78 each 23 10 guides 26 20 guides @ $9 each 28 Returned 30 guides to supplier that were purchased on July 12 due to a printing error a A stocktake on July 31 revealed Paul had 45 Ready for Lift Off guides on hand Schedule of Accounts Payable as at 31 July 2021 Details Nothing but Support Vaulters Unlimited Big Sticks Balance 742.50 24860 7040 32642.50 August 4 6 8 10 12 13 15 Received a cheque from Junior Jumpers as full payment of their account and gave a 10% discount for early payment. Sold 50 Ready for Lift Off training guides on credit to The Big Leapers for $900 (net of GST) Purchased 20 Your First Jump pole kits from Big Sticks. Each kit costs $35 and there is a delivery charge of $50. All amounts are net of GST. Made a cash sale to Jumping Jimmy when he purchased 5 Your First Jump pole kits for $77 each (GST included). Received a cheque from Pole Benders United as full payment of their account. Sold 50 Learning to Jump workbooks to Junior Jumpers for $20 (net of GST) Ran a coaching clinic for Polebenders. United at cost of $825 (GST included) Issued a cheque for $13860 as part payment of Vaulter's Unlimited Account. Paid total wages of $3,150 to two part time employees Tve. Herd and Peter Osped. Made a cash sale to Flying Fran when she purchased 5 rolls of Wrist Tape for at total of $15 (net of GST) Paid $414 (net of GST) to the Broadband Team for 6 months internet access. Purchased 50 rolls of Wrist Tape on credit from Nothing but Support for $6 each. A $25 delivery charge was also applied. (All amounts are net of GST) Issued a cheque for $6688 as full payment of Big Stick's Account. 18 20 23 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts