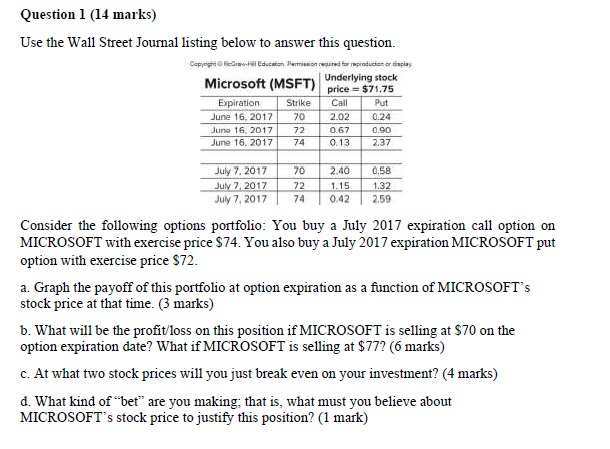

Question: Question 1 (14 marks) Use the Wall Street Journal listing below to answer this question. play Microsoft (MSFT) Geping Education Hermione reproducies or SET Underlying

Question 1 (14 marks) Use the Wall Street Journal listing below to answer this question. play Microsoft (MSFT) Geping Education Hermione reproducies or SET Underlying stock price = $71.75 Expiration Strike Call Put June 16, 2017 70 2.02 0.24 June 16, 2017 72 0 .67 0.90 June 16, 2017 74 0.13 2.37 July 7. 2017 July 7, 2017 July 7, 2017 70 72 74 2.40 1.15 0.42 0.58 1.32 2.59 Consider the following options portfolio: You buy a July 2017 expiration call option on MICROSOFT with exercise price $74. You also buy a July 2017 expiration MICROSOFT put option with exercise price $72. a. Graph the payoff of this portfolio at option expiration as a function of MICROSOFT's stock price at that time. (3 marks) 6. What will be the profit/loss on this position if MICROSOFT is selling at $70 on the option expiration date? What if MICROSOFT is selling at $77? (6 marks) c. At what two stock prices will you just break even on your investment? (4 marks) d. What kind of bet" are you making that is, what must you believe about MICROSOFT's stock price to justify this position? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts