Question: Question 1 (15 Marks) A company is thinking about changing its credit policy to speed up its cash collections. The new policy would call for

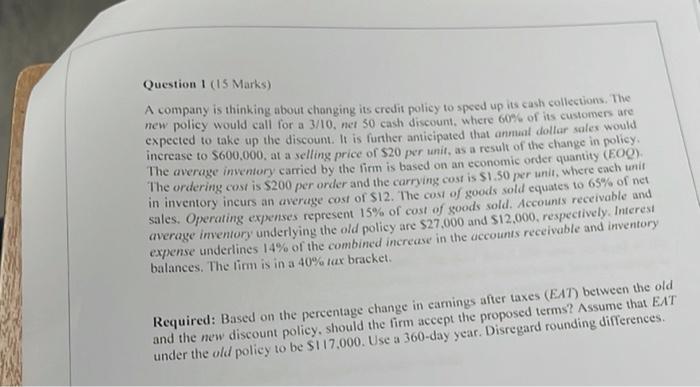

Question 1 (15 Marks) A company is thinking about changing its credit policy to speed up its cash collections. The new policy would call for a 3/10. net 50 cash discount, where 60% of its customers are expected to take up the discount. It is further anticipated that anmeldollar sales would increase to $600,000, at a selling price of $20 per unit, as a result of the change in policy The average inventory carried by the firm is based on an economic order quantity (0) The ordering cost is $200 per order and the carrying cost is $1.50 per unit, where each unit in inventory ineurs an average cost of $12. The cost of goods sold equates to 65% of net sales. Operating expenses represent 15% of cost of goods sold. Accounts receivable and average inventory underlying the old policy are $27.000 and $12,000, respectively. Interest expense underlines 14% of the combined increase in the accounts receivable and inventory balances. The firm is in a 40% lux bracket. Required: Based on the percentage change in earnings after taxes (EAT) between the old and the new discount policy, should the firm accept the proposed terms? Assume that EAT under the old policy to be $117.000. Use a 360-day year. Disregard rounding differences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts