Question: Question 1 (15 marks) Element Fund Ltd. has both borrowings and investments shown on its statement of financial position as at 31st December in non-current

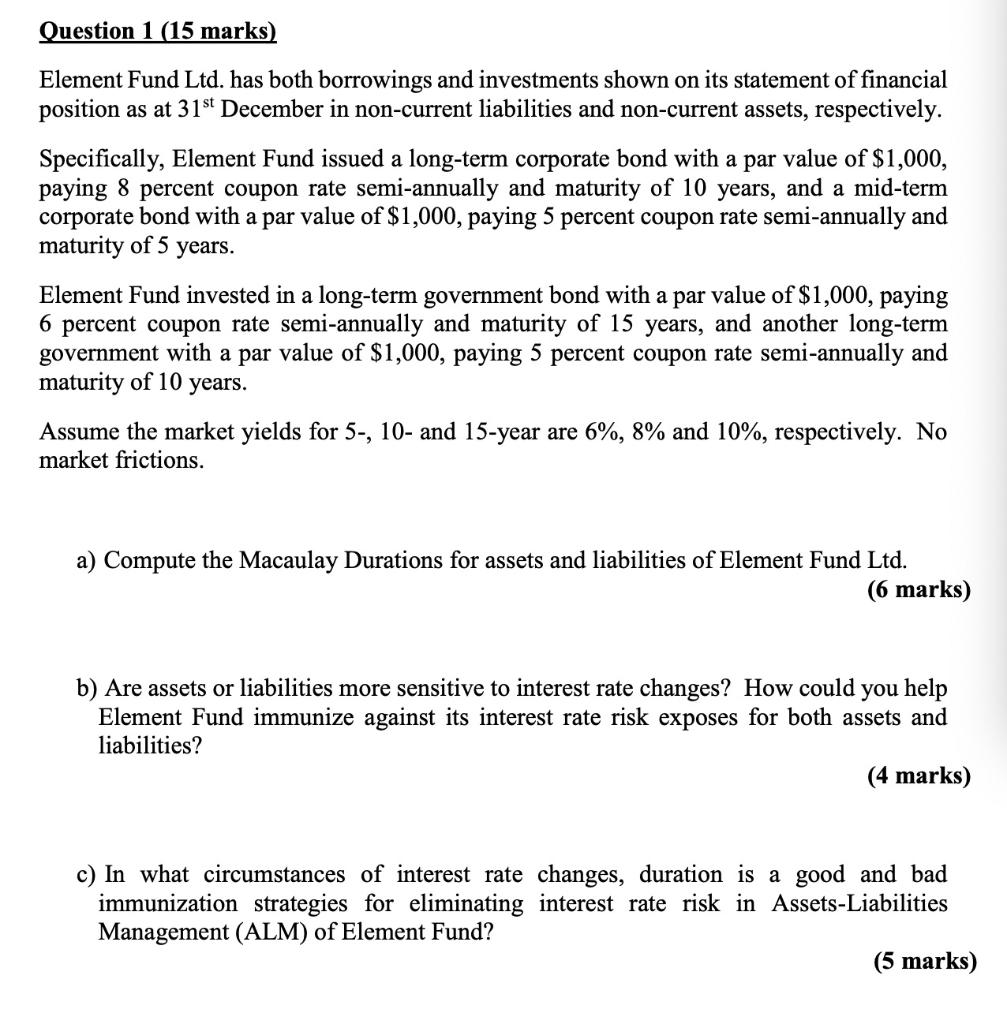

Question 1 (15 marks) Element Fund Ltd. has both borrowings and investments shown on its statement of financial position as at 31st December in non-current liabilities and non-current assets, respectively. Specifically, Element Fund issued a long-term corporate bond with a par value of $1,000, paying 8 percent coupon rate semi-annually and maturity of 10 years, and a mid-term corporate bond with a par value of $1,000, paying 5 percent coupon rate semi-annually and maturity of 5 years. Element Fund invested in a long-term government bond with a par value of $1,000, paying 6 percent coupon rate semi-annually and maturity of 15 years, and another long-term government with a par value of $1,000, paying 5 percent coupon rate semi-annually and maturity of 10 years. Assume the market yields for 5-, 10- and 15-year are 6%, 8% and 10%, respectively. No market frictions. a) Compute the Macaulay Durations for assets and liabilities of Element Fund Ltd. (6 marks) b) Are assets or liabilities more sensitive to interest rate changes? How could you help Element Fund immunize against its interest rate risk exposes for both assets and liabilities? (4 marks) c) In what circumstances of interest rate changes, duration is a good and bad immunization strategies for eliminating interest rate risk in Assets-Liabilities Management (ALM) of Element Fund? (5 marks) Question 1 (15 marks) Element Fund Ltd. has both borrowings and investments shown on its statement of financial position as at 31st December in non-current liabilities and non-current assets, respectively. Specifically, Element Fund issued a long-term corporate bond with a par value of $1,000, paying 8 percent coupon rate semi-annually and maturity of 10 years, and a mid-term corporate bond with a par value of $1,000, paying 5 percent coupon rate semi-annually and maturity of 5 years. Element Fund invested in a long-term government bond with a par value of $1,000, paying 6 percent coupon rate semi-annually and maturity of 15 years, and another long-term government with a par value of $1,000, paying 5 percent coupon rate semi-annually and maturity of 10 years. Assume the market yields for 5-, 10- and 15-year are 6%, 8% and 10%, respectively. No market frictions. a) Compute the Macaulay Durations for assets and liabilities of Element Fund Ltd. (6 marks) b) Are assets or liabilities more sensitive to interest rate changes? How could you help Element Fund immunize against its interest rate risk exposes for both assets and liabilities? (4 marks) c) In what circumstances of interest rate changes, duration is a good and bad immunization strategies for eliminating interest rate risk in Assets-Liabilities Management (ALM) of Element Fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts