Question: Question 1 (15 marks) Joint cost allocation ACME Mining Co. is a small coal mining operation. Each tonne of mined coal yields 40% Grade A

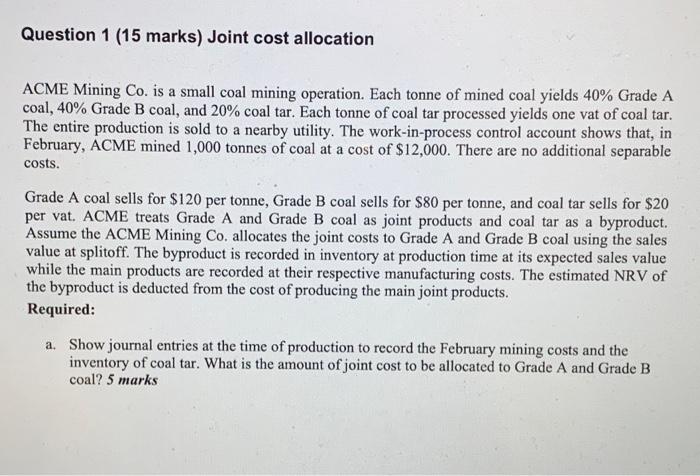

Question 1 (15 marks) Joint cost allocation ACME Mining Co. is a small coal mining operation. Each tonne of mined coal yields 40% Grade A coal, 40% Grade B coal, and 20% coal tar. Each tonne of coal tar processed yields one vat of coal tar. The entire production is sold to a nearby utility. The work-in-process control account shows that, in February, ACME mined 1,000 tonnes of coal at a cost of $12,000. There are no additional separable costs. Grade A coal sells for $120 per tonne, Grade B coal sells for $80 per tonne, and coal tar sells for $20 per vat. ACME treats Grade A and Grade B coal as joint products and coal tar as a byproduct. Assume the ACME Mining Co. allocates the joint costs to Grade A and Grade B coal using the sales value at splitoff. The byproduct is recorded in inventory at production time at its expected sales value while the main products are recorded at their respective manufacturing costs. The estimated NRV of the byproduct is deducted from the cost of producing the main joint products. Required: a. Show journal entries at the time of production to record the February mining costs and the inventory of coal tar. What is the amount of joint cost to be allocated to Grade A and Grade B coal? 5 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts